Authors

Daniel Mikkelsen[1]Senior partner in McKinsey’s London office., Simona Viscardi[2]Partner in McKinsey’s Milan office., Massimo Montes[3]Engagement manager in McKinsey’s Milan office. and Francesca Paola De Amicis[4]Associate in McKinsey’s Milan office.

In the last couple of years, banks have shown significant progress with respect to ESG (environmental social and governance) and climate change management, undertaking several actions: outlining ESG and net-zero strategies, setting up dedicated board-level governance and organizations, developing risk management frameworks which allow to estimate and mitigate climate risk, and reporting and disclosure frameworks which promote increasing transparency and comparability towards the markets.

Having set the basics on climate change management will allow banks to play a flywheel role in supporting climate transition, acting as a “multiplier” for the significant public funds allocated to green transition within the Next Generation EU and local recovery plans, and tackling significant business opportunities, both in terms of lending and funding (sustainable loans and green bonds) and in terms of sector-specific products to mitigate climate risks (e.g., insurances in agriculture) or commission-based services to facilitate the transition (e.g., to electric vehicles).

The acceleration of EU banks towards the green transition has been pushed by several forces: investors, regulators and supervisors, competitive pressure, general public, and think-tanks.

In this article, we will deep dive on the regulatory and supervisory initiatives which have significantly induced banks towards an acceleration in managing climate-change challenges: we will provide an overview of the most important regulations and supervisory expectations; outline respective implications for banks; focus on what still needs to happen for banks to support the transition at full potential, both in terms of enabling factors (e.g., skills, data) and remaining business challenges.

In line with the current status of the banking industry, although in this article we mostly focus on climate-change, in multiple instances we extend the discussion to ESG aspects more broadly (including the social and the governance ones), within the dimensions where banks are addressing them more comprehensively. Specifically, despite environmental risks include other factors beyond climate, so far banks have concentrated their actions on climate-related ones, while practices around other environmental factors (e.g., natural disasters or biodiversity) in Europe are just emerging as we speak.

1. Context

Climate change is no longer optional. The world is rapidly moving towards a resource efficient economy, with a global sustainability push driven mainly by a significant increase in climate-related policies, investments in renewable energy capacity and governmental sustainability-related financing.

In this evolving scenario, the European Union is acting as a first mover, especially because of the climate regulatory and supervisory pulse that has arisen in recent years. As a matter of fact, the EU is front running – among others – the process of setting global standards, for instance through the signing of the EU Green Deal that entails direct implications on more than 200 regulations with its aim for the European Union to become the world’s first “climate-neutral bloc” by 2050 across different sectors. Moreover, the EU has launched a dedicated effort to finance sustainable projects through public funding with its €1.8 trillion of Next Generation EU Recovery Plan, including priority initiatives focused on energy efficiency and building requalification, green transition and sustainable local mobility, protection and enhancement of the territory and of water resources, green enterprises and circular economy. The European Union has also been the region mainly driving the push towards clear commitments during COP26 (including the setting of the target for coal-fired power phase-out by 2030 for most countries and the launch of the Global Methane Pledge).

Moving to the rest of the world, the United States – committed to net zero emissions by 2050 and supporters of the Global Methane Pledge during COP26 – are riding the climate change momentum with an increased political focus and a strong local sentiment of sustainability accompanied by ambitious targets to reverse climate policies.

To conclude the quick snapshot of the worldwide panorama, China and India set their carbon neutrality objective by 2060 and 2070, respectively, and are making progress in climate targets leveraging a rigorous and efficient execution power, yet still with significant room for improvement.

Financial institutions have crucial roles to play in the transition to net zero, which requires about €28 trillion cumulative investments by 2050, spread across different industries, mostly transportation and aviation, construction, and power generation.

Although the road to net zero is far from clear and the “path to net-zero equation” is not solved yet, leaders in the financial industry are playing offense and are embarking on efforts to develop a full potential view on how to achieve net-zero emission targets while capturing growth opportunities, innovating on product development, and creating competitive distance.

Climate and ESG topics have become increasingly important. Four forces are converging to make climate change a top-of-mind topic for senior bank executives:

- Pressure from investors and other stakeholders. Investors are factoring into their choices the risk deriving from environmental impacts linked to the activities of companies. There is a growing awareness that ESG factors have a strong influence on a company’s long-term performance. Investors and the public have pressured the largest banks to commit to net-zero portfolio alignment.

- Rapidly evolving competitive landscape and peer pressure. Financial institutions are accelerating on public commitments to net zero and on the definition of financed emission targets. The creation of dedicated initiatives and alliances (e.g., Net-Zero Banking Alliance (NZBA), Net-Zero Asset Managers Initiative (NZAMI)) has pushed financial players towards a new set of methodological standards and disclosures. As of January 31, 2022, more than 100 global banks have indeed made commitments since the creation of NZBA (April 2021) to realign their portfolios toward these goals. Over half of these are in Europe, with many more expected. Furthermore, new methodologies have been identified to scientifically measure financed emissions and set targets (e.g., SBTi – Science Based Targets initiative).

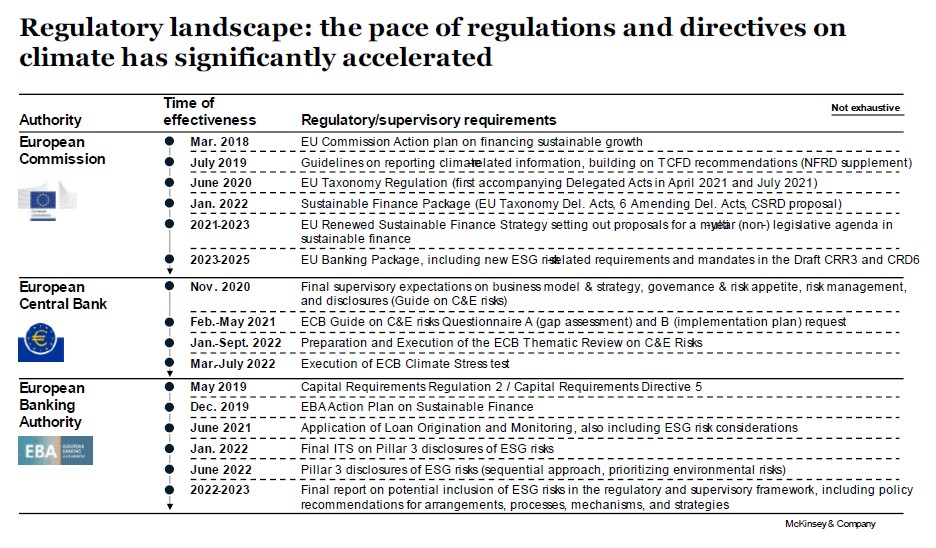

- Heightened regulatory requirements and supervisory expectations. The current regulatory and supervisory context has been evolving rapidly, with tighter climate-specific expectations already issued by the European Commission (EC), the European Banking Authority (EBA), and the European Central Bank (ECB).

- Increased scrutiny by NGOs and more green activism events. The continuous publication of dedicated reports focusing on emission reductions and climate-related topics, coupled with activists’ events against banks (the Global Day for Climate Justice and Greta Thunberg’s Fridays for Future Activists are just two examples) are pushing even further the level of awareness of the net zero imperative for credit institutions.

The accelerated pace of climate support actions posed by the four above-mentioned forces also stimulates the adoption of new business models and shapes new strategies, opportunities that banks can explore by renewing products and services supporting the transition (e.g., green sustainable lending, green bonds). In fact, banks have the occasion to act as a catalyst for corporates in the highest emitting sectors and for retail clients, whose consumers’ and investment profiles are more and more ESG-driven.

As this article is focused on regulatory requirements and supervisory expectations related to climate change and, to some extent, more broadly to ESG, in Section 2 we outline the most significant regulatory and supervisory actions banks are subject to, while in Section 3 we assess the implications for the banking industry and what still needs to happen for banks to properly support the transition.

2. EU banking regulation and supervision on climate change

Regulatory and supervisory pressure on European banks is among the strongest anywhere in the world and has significantly increased over the past months through a series of new regulatory requirements and guidelines, as well as supervisory activities conducted by the European Commission, the European Banking Authority and the European Central Bank.

As an overall direction, there is a push towards additional and enhanced transparency, including reporting and disclosure regarding the broader climate and sustainability matters, covering the identification of ESG sustainable products, climate risk exposures and climate risk management.

ECB supervision on climate and environmental risks: supervisory guidelines, stress testing and thematic review

In November 2020, the ECB published the Guide on climate-related and environmental risks, including 13 expectations that call for banks to rapidly step up their capabilities, dealing with several aspects of climate and environmental (C&E) business strategy, governance, and risk management. These expectations aim to increase the level of transparency and accuracy of all C&E domains for banks, in particular:

– Understand and integrate C&E risks within the business environment and develop a climate strategy, consistent with net-zero aspiration

– Include C&E risks within the risk appetite framework and the existing risk management framework by identifying, quantifying, managing, monitoring, and mitigating these risks

– Assign responsibilities for C&E risks management throughout the organization in accordance with the three lines of defense framework

– Consider C&E risks at all relevant stages of the credit underwriting and monitoring processes, as well as their impacts on the other types of risk (e.g., operational, reputational, market, strategic and legal risk)

– Establish internal reporting on material C&E risks and regulatory disclosures on climate-related practices

– Assess the impact of climate events on banks’ portfolio, through scenario analysis and climate stress testing exercises.

Following the release of the ECB Guide on climate-related and environmental risks, banks were requested to conduct a self-assessment in line with the 13 expectations outlined and to develop multi-annual implementation plans to advance C&E risk management (May 2021).

Additionally, since February 2022, the ECB has carried out a thematic review of banks’ practices, verifying their progress against commitments taken through implementation plans. This exercise will act as forcing device to make sure that even long-term climate commitments are turned into actions and timely delivered. In parallel to the thematic review, the ECB has conducted the first climate stress testing, which involves about 110 participating banks with different requirements, based on proportionality principle.

Both thematic review and stress testing outcomes will be gradually integrated into the SREP (Supervisory Review and Evaluation Process) assessment, initially only qualitatively and without resulting in additional capital buffer.

In the next years, also quantitative impacts will be assessed through SREP for C&E risks, in which case further measures would be required for mitigation (e.g., additional capital buffer).

The ECB has been neither the first nor the only supervisor conducting a climate stress test in Europe recently. For instance, other jurisdictions have seen national supervisors leading stress testing exercises even at earlier stages, such as Banco De España starting from transition risks in Spain, ACPR-Banque de France piloting both physical and transition risks for banks and insurers, De Nederlandsche Bank pioneering in 2018 an energy transition risk stress test for financial institutions in the Netherlands.

Principles and regulations to enhance transparency on green activities – EU taxonomy, reporting, and disclosure

«Increasing transparency makes markets more efficient and economies more stable and resilient.» As stated by Michael R. Bloomberg ‒ Chair of the Task Force on Climate-related Financial Disclosures (TCFD) established by the Financial Stability Board (FSB) ‒ climate-related financial risk disclosure has increasingly become a burning priority of multiple stakeholders, from regulators and supervisors to investors.

At the moment, more than 3,000 organizations in almost 90 countries are supporting this initiative, of which more than 1,000 financial institutions, with several banks already publishing their TCFD report, including almost all top tier EU banks.

Recently, in January 2022, the EBA has published its final draft of the Implementing Technical Standards (ITS) on Pillar 3 disclosures on ESG risks, focusing on some priority aspects, for example:

– Transition and physical risks, including information on exposures towards carbon-related assets and assets subject to chronic and acute climate change events

– Climate change connection with other “traditional” risks financial institutions are exposed to

– Mitigating actions to address those risks, including supporting counterparties in transitioning to a carbon-neutral economy and adapting to climate change

– “Greenness” of assets through relevant metrics, including Green Asset Ratio (GAR) and Banking Book Taxonomy Alignment Ratio (BTAR), to be disclosed from January and June 2024 respectively

– Qualitative information on how institutions are embedding ESG considerations in their governance, business model, strategy, and risk management framework.

Both TCFD standards and Pillar 3 package will significantly enhance comparability of external reporting on climate, currently quite fragmented and considerably different institution by institution.

As part of Pillar 3 disclosure and Non-Financial Reporting Disclosure (NFRD), the Green Asset Ratio (GAR) represents the main key performance indicator for credit institutions[5]That are subject to the disclosure obligations laid down in Articles 19a and 29a of Directive 2013/34/EU, as the single metric creating transparency on the “greenness” of the bank’s balance sheet. The ratio allows investors and regulators to conduct peer-to-peer comparisons and foster policy directives towards green finance.

The European Commission and EBA have defined a gradual journey to reach the desired level of disclosure:

- Eligibility according to the EU Taxonomy to be disclosed in 2022 (reporting period 2021); the “eligibility” concept, however, only verifies the counterparties which can potentially play environmentally sustainable activities based on economic sector classification (e.g., afforestation, electricity generation from hydropower), without exploring the effective level of “greenness” of the company’s balance sheet, nor the “green” purpose of the operation to the specific client.

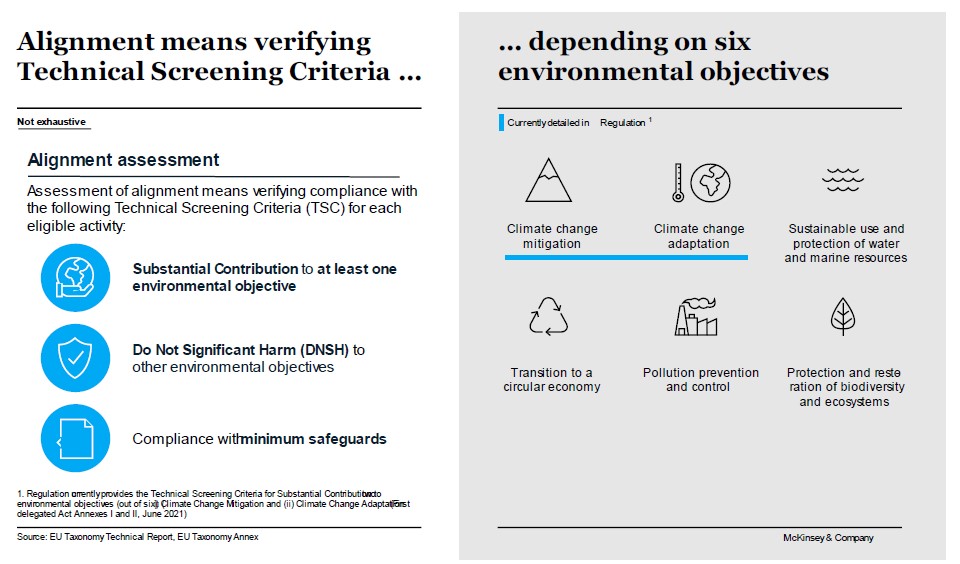

- Alignment according to the EU Taxonomy to be disclosed in 2023 by corporates and in 2024 (reporting period 2023) by financial institutions[6]2024 for Loans and advances and off-balance-sheet items (guarantees, assets under management), 2026 for trading book and other non-banking services (fees and commissions). The “alignment” concept, more restrictive than the “eligibility” concept and at the basis of GAR computation, requires compliance with the so-called Technical Screening Criteria in terms of:

- Substantial contribution to at least one of the six environmental objectives[7]7 Laid down in Article 9 of Regulation (EU) 2020/852 (climate change mitigation, climate change adaptation, transition to a circular economy, pollution prevention and control, sustainable use and protection of water and marine resources, protection and restoration of biodiversity and ecosystems), outlined by an extensive list of highly technical sector-specific conditions

- No Significant Harm (NSH) to the other environmental objectives

- Conformity to minimum safeguards, recognizing the relevance of international minimum human and labor rights and standards.

As mentioned, the EU Taxonomy regulation for the purpose of calculating the bank’s GAR applies only to corporates within the scope of the Non-Financial Reporting Directive (NFRD). However, the NFRD is currently implemented and applied differently across EU countries (e.g., different revenue thresholds, listed vs. non-listed companies), with EU systemic banks currently facing an unleveled playing field. Going forward, regulatory changes are expected to move in the direction of increasing the pool of companies subject to disclosure obligations, which will also converge towards an enhanced level playing field at EU level. The EBA publication of its ITS on Pillar 3 Disclosures of ESG risks[8]January 24, 2022, which introduces a new metric – the Banking Book Taxonomy Alignment Ratio (BTAR), complementing the GAR for smaller companies[9]EU and non-EU non-financial corporations not subject to NFRD disclosure obligations not covered by the original EU Taxonomy – plays already in this direction.

3. Implications for banks, enablers, and key outstanding challenges

Climate and ESG related regulatory and supervisory expectations have significantly accelerated banks’ pace for addressing climate change and, to some extent, ESG-driven transformations more broadly. This acceleration has led to tangible results in multiple domains – e.g., strategy, governance and organization, risk management and credit – and has also revealed significant opportunities to support the energy transition.

In the following pages we outline the current status of the industry in this domain, the enablers banks need to put in place and the outstanding challenges to be overcome in order to effectively support the transition while preserving other holistic objectives (e.g., including social fabric support).

ESG and climate strategy

The definition of an ESG strategy is a board-level topic, which affects the majority if not all the activities of the bank. Banks are required to define their level of ambition across all ESG pillars, in which the “E” and climate change components represent just a fraction, despite the most prominent, of the overall picture.

Banks, in fact, are also expected to take into consideration the local economic specificities while setting their ESG strategy and targets. For example, for countries with a socio-economic fabric mainly driven by SMEs, the green transition is potentially slower and more complex due to scarcity of qualified skills and access to capital markets. In this context, banks not only could provide the financing to support the transition, but could also support the SMEs towards the transition and make sure, while setting a green strategy, to carefully handle the potential trade-off between climate targets and social implications: reducing financing to “brown” SMEs which are currently unprepared to the green transition could negatively affect regional economic “districts” (e.g., leather, chemical) or even national economies (e.g., forestry in Slovenia).

Sustainable corporate Governance (“G”) also plays a significant role: as many empirical studies have shown, both investment returns and credit losses are highly correlated to governance KPIs. Companies which are ranked high on “sustainable governance” KPIs have proved higher long-term returns and stronger resilience. Banks rating models to assess credit risk have incorporated governance assessment since quite a while and have recently been enhanced in line with ESG principles.

Back to green strategy to address climate change, one of the most successful climate initiatives which has so far involved more than 100 banks worldwide ‒ and more than 50 banks in Europe ‒ is the Net-Zero Banking Alliance. Banks adhering to the alliance commit to aligning their financed emissions to a net-zero pathway, i.e., deriving from lending to clients, on selected high-emitting sectors with intermediate 2030 targets to be set within 36 months from joining the alliance and own bank emission by 2050.

Top-tier European and US banks have already started publishing commitments on their high-emitting sectors, usually starting with oil and gas, power generation, automotive and coal mining.

It is worth noting that some sectors are already following a net-zero trajectory thanks to the actions and enforcement of policy makers (e.g., renewable energy incentives, EU limits to automotive vehicle emissions, etc.). In those cases, banks act mainly as financing provider to support the transition plans of the clients. For other sectors, policy makers have not intervened with stringent rules or policies, either because the switch to new green technologies is expected to be slower (e.g., oil & gas) or because the technologies to address the climate topics are not yet available (e.g., agriculture). In these cases, banks act not only as financing providers to support the transition, but also as sponsors promoting accelerated alignment to net-zero objectives.

In order to achieve ambitious net-zero objectives, banks should also set up a holistic framework covering strategy, risk management, planning, credit, and business steering. More in detail, banks should activate the following key areas:

- Business steering: engage with clients on transition plans and foster origination towards virtuous players and market segments. Support clients not only through financing but also with advisory services (e.g., insurance, investments, capital markets advisory)

- Credit: ensure climate strategy operationalization through a credit underwriting and monitoring framework, which supports “green” products and operations, while also assessing and pricing climate risk properly

- Planning: ensure consistency of climate targets with the overall bank strategy and monitor progress against targets

- Risk management: ensure proper oversight of transition and physical risk related to climate targets and ambitions.

ESG and climate governance

Organizations feel the need to equip themselves with a renovated set of competences as well as “dedicated venues” within which they can discuss sustainability and climate change. In fact, more and more boards of directors have created dedicated ESG risk committees, empowered by use of newly integrated ESG tools, to support development of sustainability strategies.

At managerial level, several organizational archetypes are emerging, with ESG and climate responsibility assigned to different organizational levels. Broadly speaking, organizations can either adopt: (i) A centralized model, where a Chief[10]Mandatory for UK banks or Head of Climate and Sustainability and central ESG teams are usually appointed (either creating a new dedicated role or embedding it within an existing role), whose primary focus is on overall aspiration, partnerships, and communication; or (ii) A more decentralized model, spread throughout the organization, where functional skills at business-unit level are enhanced and coordinated, and interactions among different functions are ensured through the designation of a focal point (for example, a sustainability ambassador) for each area. Hybrid models are also more and more popular, with centralized ESG units (normally CEO-2 level) playing a coordination role, above all on new project-based initiatives, and functional skills spread across the organization (as per decentralized) model, for the respective areas of competence.

Considering the high specificities of climate topics, which often require scientific skills and industrial expertise, many banks are creating a “climate center of excellence” to perform highly specialized services (e.g., climate scenarios, modeling, energy transition plans assessment) in favor of different units of the bank.

Beyond “hard” skills, an increasing “climate change sensitivity” is perceived in most financial institutions at all level; however, while at a top-management and managerial level this is clearly reflected into daily operations, also through ESG-linked remuneration policies and performance management targets, at a more operational level climate change culture and climate risk awareness are still more scattered (multiple employees still look at “ESG and climate-friendly” actions as “marketing campaigns” and are not fully aware of the end-to-end concrete climate journey their organizations are undertaking). Climate culture dissemination and “ton from the top” will be crucial in the year to come, in order to turn recently introduced climate-related frameworks into real actions across the whole organization.

Risk Management and Credit Framework (including pricing)

Climate risks are becoming more and more evident. On the one hand, acute physical extreme events are becoming more frequent and severe (e.g., floods and droughts) and chronic impacts gradually more evident (e.g., temperature rises); on the other hand, transition risks are becoming even more concrete (e.g., methane pledge, oil price rises). As such, banks are facing increasing pressure to identify and manage climate risk in their portfolio. Banks should therefore include climate and environmental risk considerations within their risk management framework, to ensure a timely identification and monitoring of climate risk of their portfolios. As a prerequisite for climate risk inclusion into the overall Risk Management framework, a materiality assessment is performed. The materiality assessment aims to: (i) Identify the physical risk hazards and transition risk determinants which are relevant for the bank, based on sectors and geographies where the bank (and its clients) operates; (ii) Assess inter-dependencies and correlation of climate risk with the other risks the bank is facing, especially credit, operational, reputational, and legal risks in the long, medium, and short term.

On the basis of the materiality assessment outcome, banks are expected to develop unbiased methodologies to assess climate-risk impact on other “standard” risk types, both in terms of “qualitative relationships” (i.e., developing a narrative on how climate risk hazards and events drive other risks) and quantitatively. Climate risk should therefore be fully integrated into the risk taxonomy and, as a consequence, embedded into the Internal Capital Adequacy Assessment Process (ICAAP).

ICAAP integration goes hand-in-hand with the setup of a stress testing framework, which not only assesses the impact of potential climate risk scenarios on the bank’s portfolio, but is also fully integrated into the overall “general” stress testing framework, feeding highly strategic processes like the Risk Appetite Framework (RAF) and strategic planning. While banks, due to the ECB supervisory pressure, are significantly advancing on developing methodologies for granular climate risk impact estimation, they are all still facing significant challenges in integrating it into the overall “managerial” framework.

Beyond climate risk assessment and measurement, in order to steer the business towards “greener” or more “ESG-friendly” strategic objectives, banks should integrate climate and ESG considerations within the credit processes, also intervening in different elements of the credit framework, from the highly strategic ones (e.g., RAF), which steer the overall portfolio, to the more operational ones (e.g., single-name underwriting process).

Firstly, climate risks should be integrated into the set-up of the bank’s risk appetite. Sectorial limits should be developed to steer the business towards the desired portfolio composition.

Secondly, a climate risk assessment (counterparty score) should be developed at a sector and counterparty level to differentiate clients within high climate risk sectors and identify those who committed to a transition path.

Thirdly, the climate risk assessment should be integrated within the underwriting process: clients exposed to high climate risk, who did not undertake solid transition paths could be subject to reinforced mechanisms of the underwriting process to be granted new lending (e.g., higher level of credit authorities, involvement of second LoD – Line of Defense). Moreover, green products and financing supporting companies into the transition towards greener activities could be encouraged also through pricing incentivizes.

In the Large Corporate market, green finance currently commends around 25-30 percent lower pricing compared to standard products, reducing commercial banks’ margins. This impact on margins is particularly relevant for banks with higher cost of funding, for which being competitive in the green finance market is currently a significant challenge. Commercial banks are currently requesting EU regulators and supervisors to reflect a “green finance premium” as part of lower cost of funding and lower capital absorption. European regulators and supervisors are already working along this direction, for example the ECB monetary policy review will include lower haircuts for “green assets” pledged to ECB; and a review of CRR regulation towards differentiated capital requirements for green asset is also expected in 2023. As represented in the paragraph related to EU Taxonomy and Green Asset Ratio, flagging “green exposures” according to homogeneous criteria and transparency on methodologies undertaken will be key to provide supervisors confidence for incentives recognition.

Business opportunities

Governments and companies are increasingly committing to climate actions, yet significant challenges remain, not least the scale of economic transformation required to complete a net-zero transition entails the difficulty of balancing the substantial short-term risks of potentially less prepared and uncoordinated action with the longer-term risks of insufficient or delayed action.

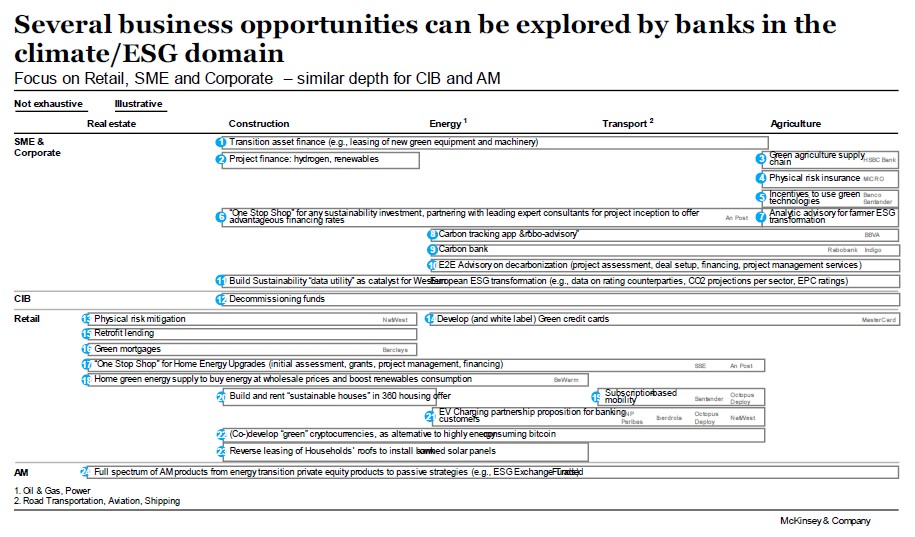

The transition would be universal, significant, and front-loaded, with uneven effects on sectors, geographies, and communities. Even if climate change is oftentimes viewed only from a risk perspective (especially given the rapid development in prudential regulations and focus point of disclosure frameworks), it simultaneously holds plenty of growth opportunities for corporates and financial institutions, including banks, funds, and insurance companies.

Realizing climate-related business opportunities is a win-win situation for both business and risk: in terms of revenues and volumes, it allows to offset the selective deleveraging actions in certain sectors with extremely brown clients or mitigate the lower spreads applied to green finance. However, it also forms a risk mitigation. For example: funding projects which contribute to the energy transition or clients which aim to reduce the emissions-intensity of their business activities is typically associated with lower levels of transition risk being assumed; developing customized insurances for territories and sectors (e.g., agriculture products) subject to physical risk would also mitigate the risk position.

A growing number of leading banks and other financial institutions is focusing on new strategies to grow, revising their product offerings, setting strategic goals for green and sustainable financing volumes, and collecting earmarked funds through issuances of green and sustainable bonds.

Consequently, competition in the sector is intensifying, requiring financial institutions to double down on their positioning and find ways to differentiate themselves. Clients no longer seek only providers of finance, but rather partners in the transition. For banks, this may entail the development of dedicated sectoral expertise to be able to advise customers on technological solutions, project planning, and execution, or to provide perspectives on broader industry developments. Banks could strategically position themselves in certain sectors, in line with their business model and environment, and create ecosystem partnerships with fintech and industrial players to develop specialized products and services (e.g., in electricity vehicles markets).

Enablers

The actions noted above should be supported by key enabling factors such as:

- Data and data strategy. Climate data are currently not available to banks in a comprehensive way. In particular, while climate science has extensive literature on climate scenarios, taxonomies, etc., almost no historical data is available on climate-related losses. In addition, data availability largely depends on the type of counterparty: large corporate clients in high emitting sectors are experiencing equivalent regulatory push, they are therefore starting producing and disclosing climate data, while SMEs are not. In order to face the data challenge, banks should consider the “ESG and climate data requirements” landscape as a whole (i.e., including scenarios, hazards, counterparty data like scores, emissions) and develop a data strategy accordingly. In this context, several “make-or-buy” decisions need to be taken. Multiple data providers are available in the market and have significantly expanded their services over the last years; however, none of them cover the full spectrum of banks’ needs. Banks could therefore develop an ESG data strategy to ensure consistent and synergic coverage of all data needs.

- Climate skills. To face such a technical topic like the climate change, which requires to combine scientific knowledge, industrial sectors knowledge, and experience with banking processes to “make things happen”, banks should decide: (i) Which kind of capabilities they want to internalize vs. gather externally (e.g., for climate scenarios, the most of banks will still be willing to leverage external energy authorities projections without any in-house development); (ii) Which/Where capabilities need to be enhanced (e.g., stress testing, financed emissions measurement and portfolio alignment, transaction due diligence); (iii) How to develop internal capabilities (e.g., hiring of climate scientists or sector specialists, training and capability building) vs. outsource selected activities (e.g., transition plans reviews).

Key challenges for banks

Despite significant progress made over the last couple of years in introducing ESG factors and setting up end-to-end framework to handle climate change and support climate transition, there are still significant challenges ahead:

a. Banks are requested by regulators to steer their portfolios towards net zero at a certain accelerated pace, in some sectors commanding more ambitious trajectories than what current commitments from clients foresee, due to lack of technology (e.g., agriculture) or high conversion costs and slow conversions to renewables (oil & gas).

b. Energy transition has been tackled by big industrial companies belonging to brown sectors, however smaller companies (e.g., SMEs) seem to lag behind. Despite selected “best in class” cases, an integrated value chain approach could be envisaged from big companies (and financial institutions) to enable SMEs to also converge towards green targets.

c. There are significant cases where “ESG negative sectors or counterparties” are key drivers of national and local economies (e.g., coal in Eastern Europe, forestry in Slovenia, tobacco in Egypt, textile, or leather manufacturing in some industrial districts); in these cases, banks need to balance the trade-off between being “climate captain” and the mission of supporting local economies and people.

d. Level playing field and alignment of incentives – while banks are committed to support the transition, policy makers and regulators are expected to put in place the necessary incentives, e.g., lower capital absorption and cost of funding for green activities, which banks can reflect into pricing to clients.

4. Conclusion

Financial institutions play a critical role in the field of sustainable development and are strongly committed to act as a flywheel towards the green transition and the goal of net-zero emissions by 2050.

The opportunity to change is concrete and Europe is paving the way with significant financing activities to support the transition. Along with this, governments, regulators, and supervisors are pushing financial institutions and all other relevant stakeholders to act now and ensure they are all meeting the mutually accepted standards and targets.

In this evolving scenario, banks are making a significant step-up creating the “foundations” to support and enable this transformation: by integrating ESG and climate components as key pillars in their business strategy and developing concrete sector-specific business opportunities; by defining new governance and organizational layouts to address the sustainability agenda; by developing a renovated set of dedicated skills and capabilities together while promoting an internal ESG and climate culture; by revising their risk management frameworks to better identify and tackle climate risk.

Nevertheless, there are still significant challenges: sensitive trade-off mainly connected to the social fabric (“S”) in specific countries or industrial districts and technological challenges on specific sectors (e.g., agriculture) still need to be sorted out to stand up to net-zero commitments and implement them across the board.

Footnotes

| ↑1 | Senior partner in McKinsey’s London office. |

|---|---|

| ↑2 | Partner in McKinsey’s Milan office. |

| ↑3 | Engagement manager in McKinsey’s Milan office. |

| ↑4 | Associate in McKinsey’s Milan office. |

| ↑5 | That are subject to the disclosure obligations laid down in Articles 19a and 29a of Directive 2013/34/EU |

| ↑6 | 2024 for Loans and advances and off-balance-sheet items (guarantees, assets under management), 2026 for trading book and other non-banking services (fees and commissions |

| ↑7 | 7 Laid down in Article 9 of Regulation (EU) 2020/852 |

| ↑8 | January 24, 2022 |

| ↑9 | EU and non-EU non-financial corporations not subject to NFRD disclosure obligations |

| ↑10 | Mandatory for UK banks |