Authors

David Bholat[1]Bank of England, Oliver Thew[2]Bank of England, and Mohammed Gharbawi [3]Bank of England

Abstract

The Covid-19 crisis continues to have a profound effect on the financial sector, with firms reassessing and adapting strategies, business models, and investment plans. Technological transformation is likely to be a significant part of this adjustment and early evidence from a survey conducted by the Bank of England suggests that the use of machine learning (ML) and data science (DS) could have an increasingly important role to play in these shifts. The technological, financial, and social changes wrought by the pandemic have also compelled businesses across the economy to look for opportunities in using different processes, developing different products, and exploring different markets. This paper looks at some of the early signs of what those changes are likely to be and how banks are responding.

The use of ML and DS in UK banking before Covid

Recent trends in ML and DS

Over the past two decades, digitalisation of society and the economy has generated vast amounts of data (WEF, 2019). DS has therefore become an increasingly important tool for businesses looking to capitalise on data-driven insights (McKinsey & Company, 2019a). This has also led to the increased use of ML across a range of businesses and sectors (McKinsey & Company, 2019b), including finance (Centre for Data Ethics and Innovation, 2020), which has seen widespread adoption of ML and DS in recent years. In 2019, The Bank of England conducted a joint survey (Bank of England, 2019) with the Financial Conduct Authority (FCA) to understand how ML was being used in UK financial services. The survey showed that ML was already being used by a majority of firms across a range of financial sub-sectors and business lines (Chart 1).

Chart 1: Two thirds of respondents have ML applications in use

Source: Bank-FCA (2019), Machine learning in UK financial services.

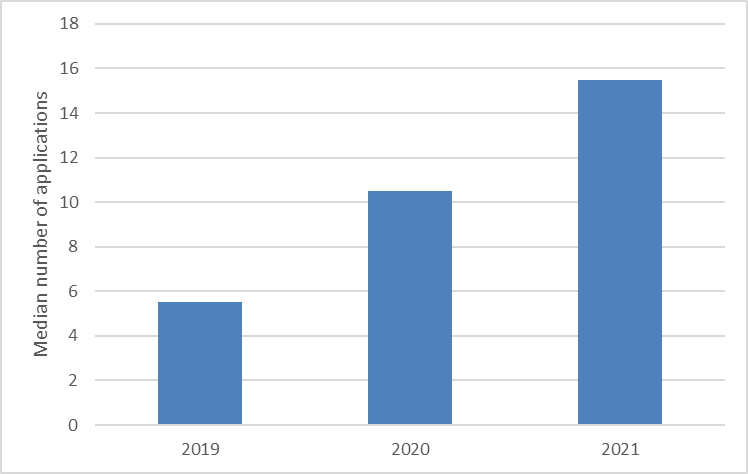

Banking was the sub-sector with the highest number of ML applications and second highest share of ML applications relative to the number of survey respondents. The two most prominent uses were customer engagement and risk management. For a majority of the banks surveyed in 2019, the use of ML had matured to the point where it was being deployed in the regular run of operations. Moreover, the majority of banks expected the number of ML applications to triple by 2021(Chart 2).

Chart 2: Banks expect significant growth in use of ML

Source: Bank-FCA (2019), Machine learning in UK financial services.

Other regulatory authorities have reported similar findings. For example, in 2019, Canada (Bank of Canada, 2019) and Hong Kong (HKMA, 2019) reported similar increases in the importance of ML and its adoption by banks in their respective jurisdictions.

These pre-Covid patterns in banks’ use of ML and DS were backed-up by a survey conducted by the Economist Intelligence Unit in February and March 2020 (The Economist, 2020b), as well as a study published in January 2020 by the Cambridge Centre for Alternative Finance (CCAF) and the World Economic Forum (WEF) (Ryll, et al., 2020). The CCAF and WEF surveyed 151 fintech start-ups and incumbent firms across 33 countries. They found that 85% of respondents already used some form of AI, most commonly in risk management, 65% expected to use AI in three or more business areas within two years, and 77% anticipated that AI would have high or very high overall importance to their business by 2022 (Chart 3).

Chart 3: Before Covid financial firms expected AI to become strategically more important by 2022

Current and expected strategic importance of AI to firms (surveyed pre-Covid)

Source: CCAF and WEF (2020), Transforming Paradigms: A Global AI in Financial Services Survey.

Benefits for households, banks and the economy

ML and DS have wide-ranging applications in financial services, which can bring benefits to consumers, businesses and the economy. For example, many banks use ML and DS for anti-money laundering (AML) processes (Delle-Case et al., 2018). In many instances, this has reduced the rate of false positives in money laundering detection,[4]False positives are notifications of potential suspicious payments or financial activity that do not end up resulting

in the filing of a suspicious activity or suspicious transaction report. with one large UK bank lowering its false positives by 70% (IBM, 2019). For consumers, this helps reduce the number of erroneously blocked or delayed payments. For banks, this frees up scarce resources and speeds up internal processes. For the economy as a whole, this can help banks and authorities more precisely identify illicit financial activity.

ML and DS also have the potential to provide more inclusive and tailored products to consumers. For example, ML is already being used by banks and fintech companies around the world to analyse newer data sources (such as social media data) to provide risk assessments of individuals with limited credit histories, which might help underserved or unbanked customers access financial services (Ryll, et al., 2020). Some UK fintechs (Holmes, 2020) and banks (McKinsey & Company, 2020) are using new data sources for consumer and business risk assessments. This trend looks set to continue with one credit rating agency announcing plans to offer UK banks access to a broader range of transactional data for consumer credit scores, including money earned and spent, council tax payments, savings and investments, and subscription payments (Business Insider, 2020).

Risks and challenges

At the same time, existing risks may increase and new risks may emerge from the use of ML and DS in financial services. Respondents to the Bank-FCA survey and a similar report from the UK’s Centre for Data Ethics and Innovation note that risks may increase due to ML’s lack of explainability (the so-called ‘black box’ problem), meaning the outputs cannot always be easily understood (Bundy et al., 2019; CDEI, 2020). In addition, ML models may perform poorly when applied to a situation they have not encountered before in the training data. This is particularly relevant in the context of the Covid pandemic when the underlying data may have changed (data drift) or the statistical properties of the data may have changed (concept drift) (Robotham, 2020; Ma and Jarrett, 2020, respectively).

These risks could materialise at an individual bank or system-wide level. Systemic risks are particularly concerning as they can create financial instability, which can in turn adversely affect the real economy and the prosperity of households and businesses. Therefore, regulators and central banks have an interest in understanding how ML and DS are being deployed and managed

The impact of Covid on ML and DS in UK banking

To better understand the impact of Covid on ML and DS in the UK banking sector, the Bank of England conducted a survey of Prudential Regulation Authority (PRA) regulated banks in August 2020.[5]The survey consists of 32 submissions in total, with 17 from UK banks, nine from foreign banks with operations in the UK, and six from insurers. The sample of insurers was too small to be judged … Continue reading The survey focused on banks’ perception of ML and DS, as well as the resourcing for current and planned ML and DS projects.

Around 40% of respondents reported an increase in the importance of ML and DS for future operations, and a further 10% of banks reported a large increase. None of the banks reported a decrease in the importance of ML and DS. This is an unexpected finding given the suggestion from some commentators that a new ‘AI winter’[6]An AI winter is shorthand for a time when interest and investment in AI wanes, for example, as occurred in the

early 1970s (Frankenfield, 2020). might unfold in as a result of reduced investment budgets due to the economic impact of Covid or because pre-pandemic ML systems may not have performed well (The Economist, 2020).

Chart 4: Half of banks view ML and DS as more important for future operations since Covid

Impact of Covid on banks’ plans for, and current use of, ML and DS

Source: BOE (2020), ML, DS and Covid survey.

Around a third of banks said there was an increase in the number of ongoing ML and DS applications. Yet only 16% of banks reported an increase in funding and/or resourcing for existing applications and a similar number reported a decrease. Similarly, around 35% of banks reported an increase in the number of planned applications. But only 23% of banks reported an increase in funding and/or resourcing for planned applications and 12% of banks reported a decrease.

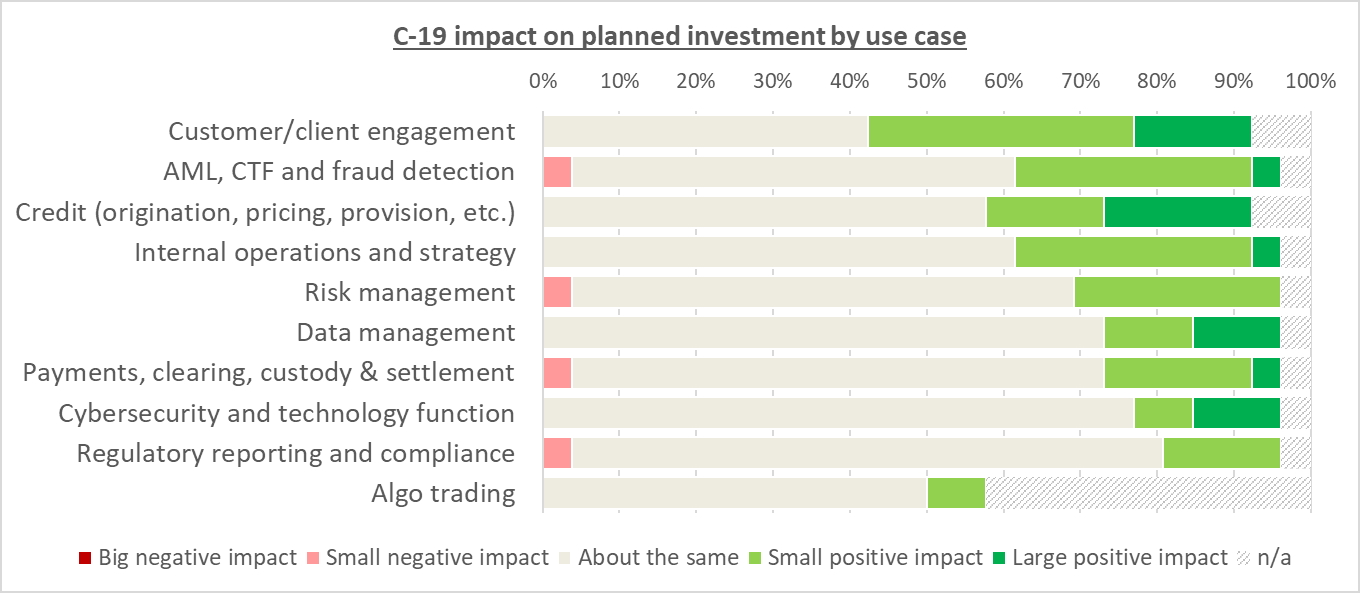

Banks may be looking to use ML and DS to increase efficiency and improve digital customer channels as they manage the cost and revenue impact of Covid. The crisis has accelerated use of ML-powered tools to manage an unprecedented uptick in customer enquiries (Motsi-Omoijiade, 2020). Half of the banks in the survey reported a ‘positive’ impact on plans for customer engagement applications. Around a third of banks also reported a ‘positive’ impact on planned investment in internal operations and financial crime applications. As the 2019 Bank-FCA survey found, ML models have already been used in all three of these areas.

Chart 5: Banks plan to invest more in ML and DS across a range of business areas due to Covid

Impact of Covid on planned investment by use case

Source: BOE (2020), ML, DS and Covid survey.

The overall planned investment picture is largely similar for all banks in the survey, with UK- headquartered banks having slightly more positive expectations. More specifically, nearly 60% of banks headquartered in the UK reported that Covid has had a ‘positive’ impact on planned investment in customer engagement applications. Similarly, almost half of these banks noted the ‘positive’ impact on planned investment in DS and ML applications in credit (including origination and pricing), with 29% of the banks reporting a large positive impact. One reason could be the use of ML to deal with the high volume of customer enquiries (Motsi-Omoijiade, 2020) and government guarantee loan applications (Hinchliffe, 2020).[7]There were more than 1.6 million applications for the Bounce Back Loan Scheme, 159,277 applications for the Coronavirus Business Interruption Loan Scheme and 1,034 applications for the Coronavirus … Continue reading These banks may also use ML and DS as they look to refine expected credit loss calculations in line with the IFRS 9 accounting regulation.[8]Expected credit loss calculation under IFRS 9 involves the definition of forward-looking scenarios to derive provisioning. The extreme nature of the Covid shock has meant that these forecasts have … Continue reading

The survey shows that around 35% of banks reported that ML and DS had a ‘positive’ impact on technologies that support remote working among employees. The same percentage also reported a positive impact on their overall risk appetite for ML projects, meaning these banks are more willing to use these techniques. At the same time, around 35% of banks reported a negative impact on ML model performance with just 8% reporting a positive impact. This is likely because the pandemic has created major movements in macroeconomic variables, such as rising unemployment and mortgage forbearance, which required ML (as well as traditional) models to be recalibrated. Other areas where banks noted a negative impact were in ‘resourcing’ and in ‘hiring/retention of skilled staff’.

Chart 6: Covid had a net negative impact on model performance

Issues (opportunities and risks) encountered by existing applications as a result of Covid

Source: BOE (2020), ML, DS and Covid survey.

It is important to note that while Chart 6 indicates where net ‘positive’ or negative effects are felt, the numbers do not tell us the extent of these effects, beyond small or large, nor indeed how they may impact banks’ business models or financial performance. More research is needed to gauge how material the affected ML/DS models are to banks’ overall performance, operations and risk profile, and hence the overall impact of the crisis.

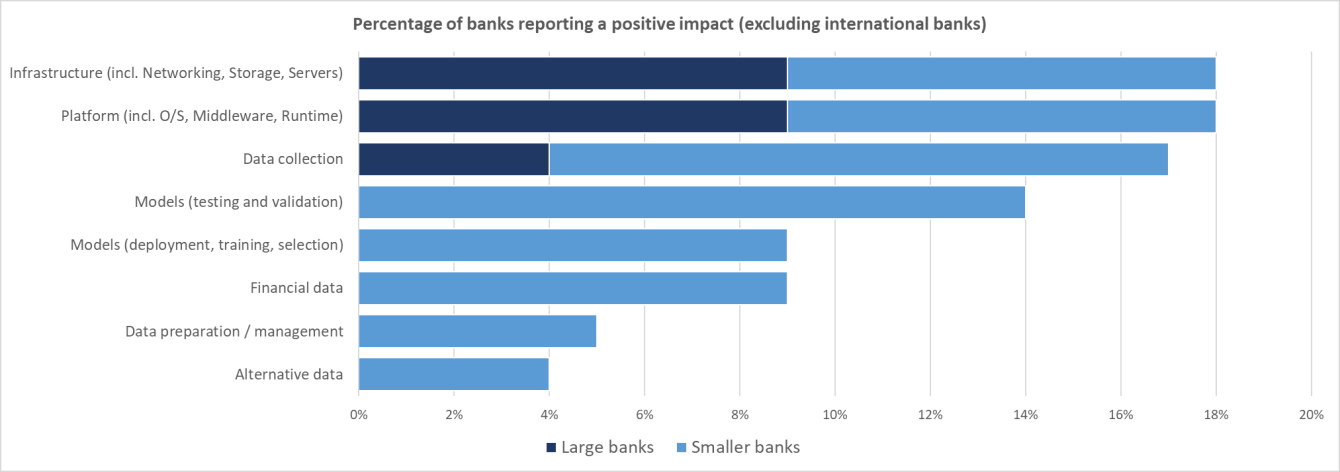

Finally, there were marked differences between small and large UK[9]The PRA divides all deposit-takers it supervises into five ‘categories’ of impact. ‘Large banks’ here refers to the Category 1 banks, namely, the most significant deposit-takers whose size, … Continue reading banks with respect to their use of third-party vendor products and services. Chart 7 shows that smaller banks reported a ‘positive’ impact (eg in terms of performance, impact, use) of Covid on all categories of DS and ML, with data collection, and model testing and validation being the areas with the largest ‘positive’ impact. Large UK banks reported a ‘positive’ impact on use of outsourced platforms and infrastructure. These findings are in line with market intelligence that smaller banks are looking to increase their use of off-the-shelf ML products. This stands to reason given the generally more substantial in-house data and analytical capabilities of large banks.

Alongside the usual risks associated with outsourcing, the use of ML and DS can pose additional risks and challenges (PRA, 2021a). For example, outsourced ML models may be more difficult to interpret because detailed knowledge in terms of how they were developed resides outside the bank. This can make it more difficult for banks to understand how the model works and to monitor performance, which could result in unexpected or unexplained performance, and risks materialising. If multiple banks use the same third-party provider and ML model, this could also potentially lead to an increase in herding, concentration and even the possibility of systemic risks where methodologies are common.

Chart 7: Covid had a positive impact on outsourcing and the use of third-party providers by large banks

Source: BOE (2020), ML, DS and Covid survey.

Explaining the survey findings

Prior to the survey, we expected that UK banks’ investment in ML and DS in response to Covid might follow the same historical pattern as other business investments during an economic downturn. Most businesses tend to respond to negative macroeconomic shocks by reducing expenditure, including spending on investment and innovation (Archibugi, 2013). In this way, business investment is typically pro-cyclical (Younes et al., 2020), rising in upswings and falling in downturns (Barlevy, 2007).

A major reason businesses reduce investments in innovation during economic downturns is the need to prioritise near-term cash flow rather than long-term technology projects. Businesses may become increasingly hesitant to invest in long-term capabilities when revenues are declining, and when there is higher uncertainty around future profits. There is plenty of evidence to suggest that uncertainty has increased during the pandemic (Altig et al., 2020). Our Decision Maker Panel survey (DMP, 2020), designed to be representative of the population of UK businesses, found that 70% of firms viewed overall economic uncertainty as high or very high in August 2020 when we conducted our survey.

Yet the Covid survey shows that banks’ investment and interest in ML and DS has held up. The strategic imperative to drive efficiency through automation and has perhaps been reinforced by the low interest rate environment. Furthermore, the nature of this shock means that demand for banking and other financial services may not have suffered to the same degree as other industries like hospitality (Office for National Statistics, 2020), given the extent and impact of lockdown measures.

The pandemic has also catalysed more extensive use of computers and smartphones for commerce, remote working and socialising (Kemp, 2020). This has likely increased the amount of data businesses have available to them. This in turn is likely to increase demand for data scientists, data engineers and other IT professionals (CDEI, 2020). Ultimately, if necessity is the mother of all invention, then Covid has arguably accelerated demand for data and technical innovation (Taalbi, 2017).

Banks have benefited from ML during the pandemic

In March 2020, the Bank of England put in place a package of measures to help mitigate the economic shock resulting from Covid (BoE, 2021). The UK Government also provided a range of financial support for businesses, including government-guarantee loan schemes. As noted earlier, some UK banks used ML (Temenos, 2020) to process the high volume of government guaranteed loan applications (Curtis, 2020), resulting in increased operational efficiency.

As the emphasis was on providing finance to businesses quickly during the early stages of the pandemic, lenders were given a 100% government guarantee on Bounce Back Loans, and borrowers could apply in a streamlined process with no assessment of their creditworthiness. Market intelligence suggests that banks are now using ML to enhance their credit risk management and to help identify and manage higher risk loans within certain portfolios, some of which may be expected to have higher default rates compared to other loan portfolios (NAO, 2020).

Covid may amplify certain risks associated with ML

As the survey highlights, Covid has had a negative impact on the performance of some ML models. This is linked to the fact that ML models’ performance can change or deteriorate under conditions different to those displayed in the data on which they were originally trained. This can occur either when the underlying data changes (data drift) or the statistical properties of the data change (concept drift). The Covid crisis has led to both data and concept drift, which has challenged models in unusual and unexpected ways. Therefore, monitoring for data drift and concept drift is one of the key challenges for firms to ensure appropriate risk management.

Our survey also showed that small banks have increased their use of third-party providers of data, infrastructure, and off-the-shelf or bespoke ML models as a result of Covid. As previously mentioned, while there are many advantages to outsourcing and third-party provider models, they can carry additional operational risks that may be amplified as banks seek to integrate new ML applications into existing legacy IT systems PRA (2021b).

What next for ML and DS?

The repercussions of the Covid crisis, including its impact on ML and DS trends in financial services, will likely be with us for many years to come and firms across the sector, including banks, are reappraising the use of data-driven technologies to augment revenue streams, refine cost reduction programmes, and enhance risk management processes. Against a potential post-pandemic background of persistently low interest rates, increasing competition, and subdued economic conditions, the opportunities to grow revenues in retail and commercial banking may be limited. The focus would therefore remain on cost containment or cost reduction as the main drivers of profitability. This implied increase in efficiency and productivity is likely to be achieved primarily through technological transformation, including the adoption and use of ML and DS.

Technological transformation carries with it significant execution risk and the operational risks run by firms with ambitious automation programmes may well increase in the short term. Firms will also need to keep a keen eye on the skills base necessary to ensure that the technical and cultural aspects of change are managed effectively and appropriately.

The directions in which ML and DS will move over the next few years are dictated by an evolving set of factors propelled and accelerated by the pandemic. These could be at the technological level, with ever increasing use of alternative data, cloud, or off-the-shelf ML solutions; the firm level, with more automation given additional impetus by virtual and agile working patterns; and the societal level, where regional and demographic variations may push firms to use ML and DS in devising more localised and narrowly targeted products.

The pandemic has also altered, perhaps permanently, strategic priorities, objectives, and plans. It has made it much easier to argue for more decentralised business models and organisational structures. ML and DS are key components in managing an effective distributed and networked business.

References

Altig, D., Baker, S., Barrero, J.M., Bloom, N., Bunn, P., Chen, S., Davis, J.D., Leather, J., Meyer, B., Mihaylov, E., Mizen, P., Parker, N., Renault, T., Smietanka, P., and Thwaites, G. (2020). Economic uncertainty before and during the Covid-19 pandemic. Staff Working Paper No. 876. Available at: Bank of England Staff Working Paper No. 876 (Accessed on April 21, 2021).

Archibugi, D., Filippetti, A., and Frenz, M. (2013). The impact of the economic crisis on innovation: Evidence from Europe. Technological Forecasting and Social Change, 80 (7), 1247-1260.

Bank of Canada (2019). Financial System Survey Highlights. May 2019. Available at: Financial System Survey Highlights—May 2019 – Bank of Canada (Accessed on April 21, 2021).

Bank of England (BoE) (2019). Machine learning in UK financial services. Financial Conduct Authority. October, 2019. Available at: Machine learning in UK financial services (bankofengland.co.uk) (Accessed on April 21, 2021).

Bank of England (BoE) (2020). Our response to coronavirus (Covid). Available at: Our response to coronavirus (Covid) | Bank of England (Accessed on April 21, 2021).

Barlevy, G. (2007). On the cyclicality of research and development. American Economic Review, 97 (4), 1131-1164.

Bundy, A., Crowcroft, J., Ghahramani, Z., Reid, N., Weller, A., McCarthy, N., and Montgomery, J. (2019). Explainable AI: the basics. The Royal Society. Available at: Explainable AI: the basics (royalsociety.org) (Accessed on April 21, 2021).

Business Insider (2020). Experian brings its open banking-powered credit score tool to the UK. Available at: Experian Debuts Credit Score Improving Tool in the UK (businessinsider.com) (Accessed on April 21, 2021).

Centre for Data Ethics and Innovation (CDEI) (2020). CDEI AI Barometer. Available at: CDEI AI Barometer – GOV.UK (www.gov.uk) (Accessed on April 21, 2021).

Curtis, J. (2020). £2bn of ‘bounce back’ loans for SMEs approved in first 24 hours. CityAM. Available at: £2bn of bounce back loans for SMEs approved in first 24 hours : CityAM (Accessed on April 21, 2021).

Decision Maker Panel (DMP) (2020). Monthly Decision Maker Panel data. Bank of England. August 2020. Available at: Monthly Decision Maker Panel data – August 2020 | Bank of England (Accessed on April 21, 2021).

Delle-Case, A., Bailey, N., Carr, B., and Ekberg, M. (2018). Machine Learning in Anti-Money Laundering. Institute of International Finance. Available at: https://www.iif.com/portals/0/Files/private/32370132_iif_machine_learning_in_aml_-_public_summary_report.pdf (Accessed on April 21, 2021).

Hinchliffe, R. (2020). Temenos helps UK banks speed up BBLS distribution “in days”. Fintech Futures. Available at: Temenos helps UK banks speed up BBLS distribution “in days” – FinTech Futures (Accessed on April 21, 2021).

HM Treasury (2021). HM Treasury coronavirus (COVID-19) business loan scheme statistics. Available at: HM Treasury coronavirus (COVID-19) business loan scheme statistics – GOV.UK (www.gov.uk) (Accessed on April 21, 2021).

Holmes, C. (2020). Credit scoring: Going alternative. Finextra. Available at: Credit scoring: Going alternative (finextra.com) (Accessed on April 21, 2021).

Hong Kong Monetary Authority (2019). Report on Artificial Intelligence (AI) Application in Banking. Available at: https://www.hkma.gov.hk/eng/news-and-media/press-releases/2019/12/20191223-4/ (Accessed on April 21, 2021).

IBM (2019). Fighting financial crime with AI. How cognitive solutions are changing the way institutions manage AML compliance, fraud and conduct surveillance. Available at: WKLQKD3W (ibm.com) (Accessed on April 21, 2021).

IFRS (2021). IFRS 9 Financial Instruments. Available at: IFRS – IFRS 9 Financial Instruments (Accessed on April 21, 2021).

Kemp, S. (2020). Digital 2020: July global statshot. Datareportal. Available at: Digital 2020: July Global Statshot — DataReportal – Global Digital Insights (Accessed on April 21, 2021).

Ma, V., and Jarrett, D. (2020). The COVID-19 Concept drift, using Sydney ferry activity data. Available at: The COVID-19 Concept drift, using Sydney ferry activity data | by Drew Jarrett | Towards Data Science (Accessed on April 21, 2021).

McKinsey & Company (2019a). Catch them if you can: How leaders in data and analytics have pulled ahead. Available at: https://www.mckinsey.com/business-functions/mckinsey-analytics/our-insights/catch-them-if-you-can-how-leaders-in-data-and-analytics-have-pulled-ahead (Accessed on April 21, 2021).

McKinsey & Company (2019b). Global AI Survey: AI proves its worth, but few scale impact. Available at: Survey: AI adoption proves its worth, but few scale impact | McKinsey (Accessed on April 21, 2021).

McKinsey & Company (2020). Managing and monitoring credit risk after the COVID-19 pandemic. Available at: Credit risk after COVID-19 | McKinsey (Accessed on April 21, 2021).

Motsi-Omoijiade, I. (2020). How AI is helping banks meet the challenges of COVID-19. Birmingham Business School Blog. Available at: How AI is helping banks meet the challenges of COVID-19 – Birmingham Business School Blog (bham.ac.uk) (Accessed on April 21, 2021).

National Audit Office (NAO) (2020). Investigation into the Bounce Back Loan Scheme. Available at: Investigation into the Bounce Back Loan Scheme – National Audit Office (NAO) Report (Accessed on April 21, 2021).

Office for National Statistics (2020). Coronavirus and the impact on output in the UK economy: September 2020. Available at: Coronavirus and the impact on output in the UK economy – Office for National Statistics (ons.gov.uk) (Accessed on April 21, 2021).

Prudential Regulation Authority (PRA) (2021a). PS7/21 | CP30/19 Outsourcing and third-party risk management. Policy Statement 7/21 | Consultation Paper 30/19. Available at: PS7/21 | CP30/19 Outsourcing and third party risk management | Bank of England (Accessed on April 21, 2021).

Prudential Regulation Authority (PRA) (2021b). PS6/21 | CP29/19 | DP1/18 Operational Resilience: Impact tolerances for important business services. Policy Statement 6/21 | Consultation Paper 29/19 | Discussion Paper 1/18. Available at: PS6/21 | CP29/19 | DP1/18 Operational Resilience: Impact tolerances for important business services | Bank of England (Accessed on April 21, 2021).

Robotham, P. (2020). Why your models might not work after Covid-19. Available at: Why your models might not work after Covid-19 | by Patrick Robotham | Eliiza-AI | Medium

Ryll, L., Barton, M.E., Zhang, B.Z., McWaters, J., Schizas, E., Hao, R., Bear, K., Preziuso, M., Sege, E., Wardrop, R., Rau, R., Debata, P., Rowan, P., Adams, N., Gray, M., Yerolemou, N. (2020). A Global AI in Financial Services Survey. University of Cambridge and World Economic Forum. Available at: Transforming Paradigms – CCAF publications – Cambridge Centre for Alternative Finance – Centres – Faculty & research – CJBS (Accessed on April 21, 2021).

Taalbi, J. (2017). What drives innovation? Evidence from economic history. Research Policy, 46 (8), 1437-1453.

Temenos (2020). Temenos Helps UK Banks Respond Rapidly to Surging Demand for Bounce Back Loans During Covid-19. Available at: Temenos Helps UK Banks Respond Rapidly to Surging Demand for Bounce Back Loans During Covid-19 – Temenos (Accessed on April 21, 2021).

The Economist (2020a). An understanding of AI’s limitations is starting to sink in. Available at: An understanding of AI’s limitations is starting to sink in | The Economist (Accessed on April 21, 2021).

The Economist (2020b). Forging new frontiers: advanced technologies will revolutionise banking. Available at: Forging new frontiers: advanced technologies will revolutionise banking – The Economist Intelligence Unit (EIU) (Accessed on April 21, 2021).

World Economic Forum (2019). How much data is generated each day? Available at: How much data is generated each day? | World Economic Forum (weforum.org) (Accessed on April 21, 2021).

Younes, G.A., Ayoubi, C., Ballester, O., Cristelli, G., van den Heuvel, M., Zhou, L., Pellegrino, G., de Rassenfosse, G., Foray, D., Gaule, P., Webster, E.M. (2020) COVID-19: Insights from Innovation Economists SSRN Working Paper No. 3575824. Available at SSRN: https://ssrn.com/abstract=3575824 or http://dx.doi.org/10.2139/ssrn.3575824 (Accessed on April 21, 2021).

Footnotes

| ↑1, ↑2, ↑3 | Bank of England |

|---|---|

| ↑4 | False positives are notifications of potential suspicious payments or financial activity that do not end up resulting in the filing of a suspicious activity or suspicious transaction report. |

| ↑5 | The survey consists of 32 submissions in total, with 17 from UK banks, nine from foreign banks with operations in the UK, and six from insurers. The sample of insurers was too small to be judged representative of the sector and the results are not included in this article. Note that, although the survey only covers 26 banks, the assets of those banks account for close to 90% of all UK bank assets. |

| ↑6 | An AI winter is shorthand for a time when interest and investment in AI wanes, for example, as occurred in the early 1970s (Frankenfield, 2020). |

| ↑7 | There were more than 1.6 million applications for the Bounce Back Loan Scheme, 159,277 applications for the Coronavirus Business Interruption Loan Scheme and 1,034 applications for the Coronavirus Large Business Interruption Loan Scheme between March and October 2020 (HM Treasury, 2021) |

| ↑8 | Expected credit loss calculation under IFRS 9 involves the definition of forward-looking scenarios to derive provisioning. The extreme nature of the Covid shock has meant that these forecasts have needed amending. |

| ↑9 | The PRA divides all deposit-takers it supervises into five ‘categories’ of impact. ‘Large banks’ here refers to the Category 1 banks, namely, the most significant deposit-takers whose size, interconnectedness, complexity, and business type give them the capacity to cause very significant disruption to the UK financial system by failing or by carrying on their business in an unsafe manner. Survey respondents included all Category 1 banks and 72% of Category 2 banks by assets. |