Authors

Nicole Jonker[1]De Nederlandsche Bank (DNB), the Netherlands., Carin van der Cruijsen[2]De Nederlandsche Bank (DNB), the Netherlands., Michiel Bijlsma[3]SEO Amsterdam Economics, the Netherlands. [4]Tilburg University, the Netherlands., Wilko Bolt[5]De Nederlandsche Bank (DNB), the Netherlands. [6]Vrije Universiteit, Amsterdam, the Netherlands.

Abstract

COVID-19 has affected almost every aspect of our daily lives including the way we pay. The pandemic caused a large drop in the use of cash triggering more contactless payments at the point of sale. The question comes up whether this change in payment usage is temporary or permanent. We use payment diary survey data to study the shift in payment behaviour and payment preferences. Since the start of the lockdown in the Netherlands the usage of debit card versus cash has increased by 10 percentage points. The initial drop in cash usage by 17 percentage points has only partly been reversed. The reversal occurred especially with people aged 65 and above as well as with people with a low-income. Thus the shift appears to be long-lived. Moreover, the pandemic has also resulted in a shift in payment preferences. People who used to prefer electronic payment have shifted to contactless payment. The percentage of people preferring cash only slightly decreased from 21% to 20%.

1. Introduction

The COVID-19 pandemic is affecting almost every aspect of our daily lives. The pandemic has not only made the way we live more contactless but also the way we pay. Although lockdowns have led to a sharp fall in consumer spending, electronic payment instruments at the point of sale (POS) became more attractive relative to cash by avoiding close physical contact with the cashiers. Retailers promoted the usage of contactless payments at the expense of cash, and banks made it easier and more convenient for consumers to pay contactless. As a result, electronic payment instruments gained further ground.

In this article we illustrate the impact of the COVID-19 pandemic on consumer payment behaviour and payment preferences using unique payment diary data collected among a representative panel of Dutch consumers. This payment diary data includes information both on cash payments and electronic POS payments. Moreover, in addition to payment usage information, our diary data also provides useful information on payment preferences. The daily data used in this paper covers the Netherlands and ranges from January 1 2019 until December 31 2020. The nature of the data allows us to examine whether the effects of the outbreak of COVID-19 and its associated measures led to a shift in payment behaviour and payment preferences. If the shift increases adoption by forcing consumers to incur learning cost and breaking cash habits, or if the shock leads to a change in preferences, the ensuing change in payment behaviour is expected to persist. This would then create extra incentives for commercial banks and other third parties to speed up the provision of contactless, mobile and online payment services.

The Netherlands offers a particularly good setting to analyse the impact of the COVID-19 pandemic and its associated containment measures on payment behaviour and preferences. First, cash and debit cards are – de facto – the only two payment instruments that matter at the point of sale. Payment choice in the Netherlands is effectively a binary choice; credit cards, store value cards or checks hardly play any role for shopping at the point of sale. In 2019, 32% of POS payments were in cash, 24% by debit card with PIN and 43% contactless (i.e. a total of 99%; DNB 2020a). Moreover, paying contactless by debit card happens much more often than paying contactless by smartphone, as 90% of all debit cards are contactless-enabled (DNB 2020a).

Second, since the pandemic started half-March 2020, Dutch government, commercial banks and merchants have been taking measures to limit and contain the spread of the virus. Among others, this facilitated easier and more convenient contactless payments. Pre-COVID-19, consumers were required to enter their PIN code when they made a payment of more than EUR 25 and to insert their payment card into the payment terminal. If payments of EUR 25 and below reached a cumulative limit of EUR 50 the PIN code was also required. In 2020 the cumulative limit was (temporarily) increased to EUR 100 on March 19, while the transaction limit was raised to EUR 50 on March 24.

Third, merchants stimulated people to pay contactless as it lowers the likelihood of hand contact between customers and cashiers. For example, they applied doorplates and notices next to the cash counter asking and steering people to pay contactless. Moreover, the Centraal Bureau Levensmiddelenhandel (CBL) – the Dutch organisation that looks after the interests of supermarkets – appealed to consumers to pay contactless.[7]See the press release https://www.cbl.nl/pinnen-als-voorzorgsmaatregelen-tegen-coronavirus/ (in Dutch). Also the WHO (2020) has been advising to not use paper tender and to use as many cashless … Continue reading

Fourth, during the first lockdown in the Netherlands, which started on March 16 2020, people were still allowed to leave their home and visit a POS as often as they wanted, except for POS in particular sectors such as restaurants and bars, recreation and culture and the services sector. Furthermore, kindergartens, schools and universities were closed and people were encouraged to work from home and to avoid public transport as much as possible. From mid-May 2020 onwards, the imposed containment measures have gradually been relaxed, and by the beginning of July 2020 the pandemic appeared largely under control. As a result, from July 1 onwards, many of the COVID-19 measures were further relaxed by the government: the maximum of people that could visit a pub, restaurant or recreational/cultural venue was increased to 100 (but subject to 1.5m distance), people were allowed to participate in sport competitions, and those working from home, were – although not recommended – (partially) allowed to go to the office. However, on October 14 2020 the Dutch government tightened the COVID-19 containment measures again to combat a second wave of infections. Cafes and restaurants were closed again, as well as cinemas, museums, theatres, sports clubs, conference centers and sport events were cancelled. On December 15 2020 the Dutch government took a third set of measures in order to mitigate the impact of new more contagious COVID-19 variants. For instance, it closed all schools and non-essential service providers as well as non-essential shops. The interplay between containment measures, as described by the so-called Oxford OSI index, and the number of daily COVID-19 related hospitalizations is shown in Figure 1.

Figure 1: Containment measures and COVID-19 hospitalizations in the Netherlands

The remainder of this paper is structured as follows, section 2 reviews the related literature on the main drivers of payment patterns as well as the potential impact of COVID-19 on payment behaviour. Section 3 briefly describes the payment data and diary setup, while section 4 presents our main stylized facts and results. We end with a discussion and conclusion in Section 5.

2. Related literature

In the past decades numerous studies were conducted on the drivers of payment patterns and how to influence them. A wide range of factors emerges. Various studies find that cash usage increases with age, decreases with education and income, and negatively correlates with transaction amount (e.g. Jonker 2007; Arango-Arango et al. 2018, Wang and Wolman 2016). Moreover, it is shown that payment choice depends on the ability to monitor liquidity (von Kalckreuth et al. 2014), keep control of one’s budget (Hernandez, Jonker and Kosse 2017) and the perceived speed of payment, its user-friendliness, and safety (Jonker 2007; Schuh and Stavins 2010; van der Cruijsen and Plooij 2018). Financial incentives matter too (Arango-Arango et al. 2018; Bolt et al. 2010; Stavins 2018; Simon et al. 2010). In addition, payment behaviour depends on how well a payment instrument is accepted at the POS (Bagnall et al. 2016; DNB 2020a).[8]There is a limited number of studies showing the importance of socio-psychological factors – e.g. social norms, attitudes, perceptions and feelings – for payment behaviour (van der Horst and … Continue reading

In spite of this large literature on the drivers of payment behaviour, relatively little is known about the effect of external shocks on consumers’ payment behaviour. Using 2005-2008 data on the Netherlands, Kosse (2013) shows that newspaper articles on skimming fraud has a limited but significant negative impact on debit card usage on the same day. However, these small effects of informational shocks do not sustain or accumulate in the long run. In a recent paper, Choi and Loh (2019) find empirical evidence that downsizing the network of ATMs in Singapore – a densely populated city – has increased customers’ travel distances to ATMs and increased their usage of the bank’s digital platform.

The COVID-19 pandemic offers a unique opportunity to study to what extent external shocks and associated containment measures by the government, banks and retailers can result in a change in payment behaviour and payment preferences. There are a few first studies. According to Chen et al. (2020) there is some early survey evidence from Spring 2020 that cash usage at the POS by Canadian citizens has decreased at the expense of debit and credit card payments, but that the role of cash as a store of value has somewhat increased. In particular, a third of the survey respondents reported that they had decreased their use of cash in response to the pandemic. Similarly, based on a yearly payment diary carried out in the U.S., Coyle et al. (2021) find that, in general, respondents hold more cash in their wallet and as a store of value in their homes, compared to trends reported in the 2019 diary. Moreover, focusing on changing payment behaviour, the results show that approximately 20% of the respondents have switched to paying online or over the phone.

Other recent reports show that the pandemic has accelerated the use of electronic payment instruments in Europe. Four out of ten respondents in an ECB study carried out in July 2020 say they use less cash since the start of the COVID-19 pandemic and a majority of these people expect to stick to this behaviour after the pandemic has faded away (ECB 2020). The fact that electronic payment instruments have been made more convenient is the most often mentioned reason for the change in behaviour. In a recent report by the Danish central bank (Danmarks Nationalbank 2020), the analysis shows that contactless and online payments quickly gained ground while cash payments fell during the lockdown in the spring of 2020. More specifically, 30% of the Danish respondents reported increased payment card use relative to before the lockdown, and 41% reported less cash usage. The Danish study also indicates that the use of cash gradually increased during the reopening of the economy by the end of August 2020. In addition, online payments have returned to pre-lockdown levels in Denmark.

Other recent reports show that the pandemic has accelerated the use of electronic payment instruments in Europe. Four out of ten respondents in an ECB study carried out in July 2020 say they use less cash since the start of the COVID-19 pandemic and a majority of these people expect to stick to this behaviour after the pandemic has faded away (ECB 2020). The fact that electronic payment instruments have been made more convenient is the most often mentioned reason for the change in behaviour. In a recent report by the Danish central bank (Danmarks Nationalbank 2020), the analysis shows that contactless and online payments quickly gained ground while cash payments fell during the lockdown in the spring of 2020. More specifically, 30% of the Danish respondents reported increased payment card use relative to before the lockdown, and 41% reported less cash usage. The Danish study also indicates that the use of cash gradually increased during the reopening of the economy by the end of August 2020. In addition, online payments have returned to pre-lockdown levels in Denmark.

3. Payment data

Given the COVID-19 outbreak and its associated measures by the government, banks and retailers, we expect a reduction of the share of POS transactions paid in cash and an increase in the share of electronic payments since the lockdown. Moreover, there may be reasons to believe that this change in payment usage is escorted by a shift in payment preferences causing a long-lived shift in payment behaviour. It is likely that at least part of the group of prior non-users who made the step towards paying contactless and experienced the convenience and ease of paying contactless, became enthusiastic about this payment method and changed their payment preferences accordingly. Second, payment preferences depend on perceived payment instrument characteristics. COVID-19 has changed the relative cost and benefits of different payment methods in terms of health risk and safety, ease of use and likelihood of acceptance. Third, social norms may have changed. People may infer that the social norm has moved toward paying contactless and not to using cash if more and more people do so. Prior research has shown that people copy the payment behaviour of others (van der Cruijsen and Knoben 2020).

To assess the impact of COVID-19 on consumers’ payment behaviour and preferences we use unique payment diary data collected from Dutch consumers. De Nederlandsche Bank (DNB) and the Dutch Payments Association (DPA) commissioned the data collection. The main goal of the DNB/DPA Survey on Consumers’ Payments (SCP) is to monitor consumers’ payment behaviour at the POS (Jonker et al. 2018). Members of the GfK market research-panel, aged 12 years and over fill out the questionnaire. The results give a representative picture of cash and debit card usage at the POS by the Dutch. Survey participants register their payment behaviour on the registration day. They give detailed information about the transactions they made during the day such as the payment instrument used, how much they spent at each POS, and what sector the POS belongs to. In addition, participants answer an additional questionnaire. We use this part to get insight in payment preferences.

For our analysis of payment behaviour and payment references we use data from January 1 2019 until December 31 2020. For our analysis of payment preferences we used information from all participants. This results in information from around 48,000 different people. On average, we have close to 70 diaries per day. For our analysis of payment behaviour we selected the payment dairies where the respondent made at least one payment at a POS on the registration day. We exclude payments that were not made with cash or the debit card, leaving us with more than 63,000 POS payments. We focus on cash and debit card usage, as these are by far the most frequently used means of payment at the POS in the Netherlands.

4. Main stylized facts and results

Figures 2 and 3 show the change in payment behaviour and payment preferences over time. Figure 2a shows 14-days moving averages of the share of POS payments made by cash or by debit card between January 2019 until December 2020 by age class and Figure 2b by income class. We highlight three key moments in time (vertical lines): the start of the lockdown on March 16 2020, the start of the second lockdown on October 14 and the implementation of a set of additional containment measures on December 15. At the start of 2020, the proportion of cash in the total number of cash and debit card POS payments still stood at 31%. Bottoming out at 13% on 12 April 2020, cash transactions rebounded to 23% at the end of June. Overall, this suggests that a large part of the shift in payment behaviour appears to be persistent because from the second half of July onwards no major changes have been observed in consumers’ payment behaviour. While the decrease in cash use is seen across all age groups, it is most pronounced among consumers older than 65 (see Figure 2a). However, in this age group there seems to be a trend back to normal as well, which was only temporarily reversed in December 2020 after the second set of measures in the second lockdown. Thus, this age group appears to be very responsive to the containment measures.

With respect to people from different income groups, we also observe a drop in cash usage at the start of the first lockdown (see Figure 2b). This decline was largest for people in the lowest income group. Many consumers who reduced their cash payments since the COVID-19 pandemic first broke out, still made fewer cash payments at the end of the year. However, those in the lowest income group did not. They have reverted almost entirely to their previous payment behaviour. In February 2020, just before the pandemic started, they used cash for 41% of their purchases, and at the end of the year this percentage stood at 39%.

Consumers in the Netherlands have given various reasons for the change in their payment behaviour at the POS (DNB 2020b). The most frequently cited reason was that merchants strongly encouraged them to pay contactless or they did not accept cash (37%). Consumers also responded that they paid electronically more often because the government advised them to do so (36%), because paying electronically has been made more convenient, or because the virus can be transmitted via banknotes or through hand-to-hand contact with the cashier (29% for all three).

Figure 2: Payment usage (2019-2020) – by age and income group

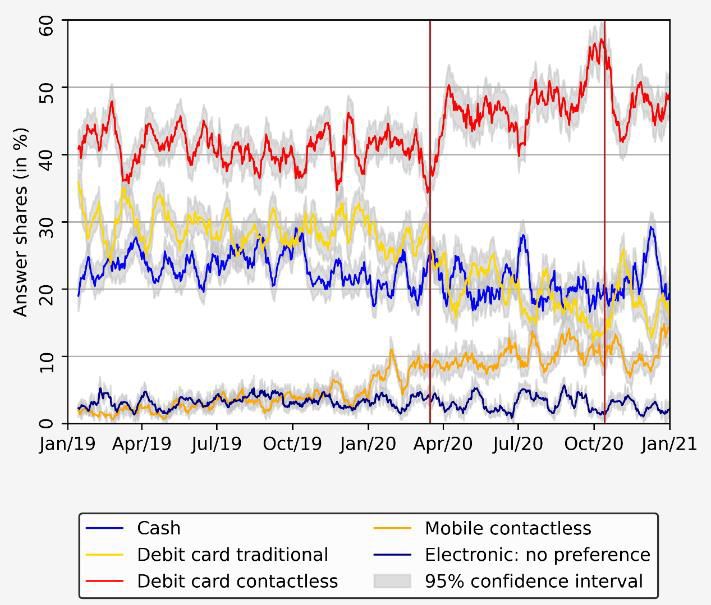

Payment preferences have also changed considerably since the start of the lockdown; contactless payments clearly gained ground. Figure 3 shows 14-days moving averages of the share of people preferring different payment methods during January 2019 until December 2020. Since March 16 2020 substantially more people developed a preference for paying contactless, whereas the share of people preferring to pay with their debit card in the traditional way (so by inserting the card into the payment terminal and providing a PIN code) decreased. Both paying contactless by debit card and mobile phone became increasingly popular. The share of consumers preferring these payment instruments increased from 39% to almost 49%, respectively, from 7% to 10%, so a combined total increase of 13 percentage points. This occurred mainly at the expense of the share of people preferring to use the PIN debit card, which dropped from 29% to 19%. Surprisingly, the share of people preferring to pay with cash only declined by 1 percentage point, from 21% to 20%.

Figure 3: Payment preferences (2019-2020)

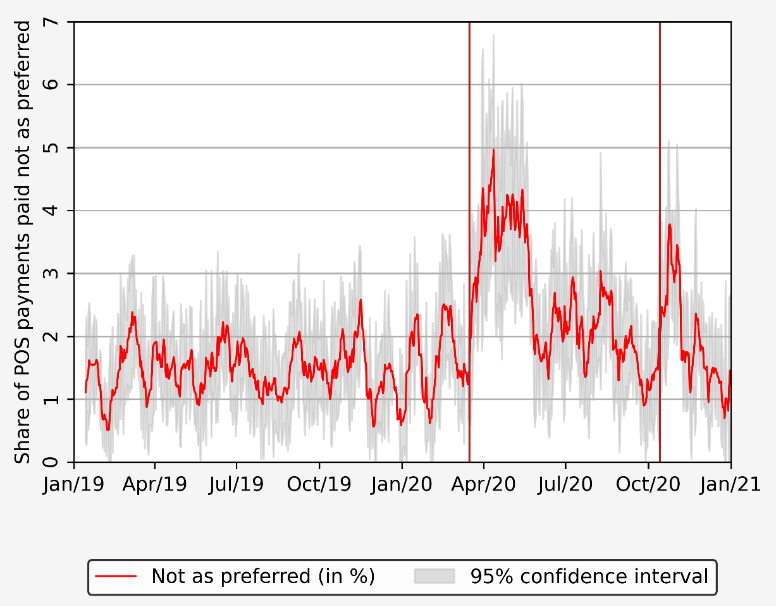

Relatedly, Figure 4 depicts the percentage of people unable to pay in their preferred way. We observe a peak after the first lockdown, which seems to subside relatively quickly as people get used to the new status quo. After the end of the lockdown another peak is observed, which may indicate that people were able to go out and shop again, but cash payments were still not possible in many places. Then, after the second lockdown comes into force, there is no indication of a substantial effect.

Figure 4: POS payments not with preferred instrument (2019–2020)

Note: 14-days moving averages

A more detailed regression analysis (using data until October 13 2020) shows that the COVID-19 pandemic has led to an increase in the likelihood of a debit card transaction at the POS in the Netherlands at expense of cash (Jonker et al. 2020). Since the start of the March lockdown the likelihood that consumers use their debit card instead of cash increased by 13 percentage point compared to debit card usage before the lockdown. Moreover, empirical evidence suggests that part of the shift in payment behaviour may be long-lived. That is, about 60 percent of this shift has persisted seven months after the start of the pandemic in the Netherlands.

Furthermore, the likelihood that someone prefers to pay contactless increased by debit card by 8 percentage points compared to before the lockdown, whereas the likelihood of preferring to use the debit card with a PIN code decreased with 6 percentage points. There appears to be no significant effect of the pandemic and associated containment measures on the likelihood that people prefer to use cash or their mobile phone. More importantly, there is no reversal of payment preferences after the end of the first lockdown. These results suggest that the changes in payment behaviour and payment preferences stem for a large part from the measures taken by government, banks and retailers and are not caused directly by the fear of getting infected. The likelihood of using the debit card for payments and the likelihood of preferring contactless do not significantly relate to the severity of the pandemic, which is proxied by the number of new infections by province (Jonker et al. 2020).

5. Conclusions

In our analysis, we find that COVID-19 and its associated containment measures initially led to a 13 percentage point increase of the likelihood of debit card versus cash usage. The impact of the pandemic on people’s payment behaviour appears to be mainly triggered by the containment measures to control the pandemic. In addition, for many people payment behaviour has not returned to pre-COVID-19 levels. The share of cash payments at the POS has only partially reversed since its lowest point in April 2020. Thus, at least part of the effect appears to be persistent, although it seems too early to tell what part of the shock is temporary and what part of the shock is permanent. Also, we conclude that the lockdown did not have a homogeneous impact on people’s payment behaviour; the effect differs across age classes and income classes. Elderly people older than 65 and people with low income seem to return to their pre-COVID payment behaviour to a larger extent relative to younger age and higher income groups. Their payment behaviour seems to fluctuate more implying that the availability of cash remains important for these groups.

Overall, our results suggest that payment behaviour will not return to its pre-pandemic level in the future as payment preferences of many people have changed. Substantially more people now prefer to pay contactless. The share of people preferring to use their debit card with a PIN code has seen a large decline, whereas the share of people fond of cash usage only slightly declined. There are several possible interpretations for the persisting lower share of cash usage. People who preferred to use cash may have continued to pay electronically because of the fear of getting the virus. It could also be that they still perceive that retailers and other people do not want them to pay by cash. Paying electronically may now be perceived as the new social norm. COVID-19, together with its associated containment measures, may have helped to break old social norms. Another plausible explanation is that COVID-19 and the subsequent measures have induced people to break their cash habits.

Our findings provide a better understanding of how an external health shock and its associated measures by the government, banks and retailers can shift payment behaviour and payment preferences. Only within a few months’ time, a persistent change in payment behaviour appears to have taken place that, if we extrapolate pre-pandemic trends, normally would have taken several years. Compared to other external shocks, the impact of the pandemic on payment behaviour has been relatively large in magnitude and long-lasting in duration.

The COVID-19 pandemic is reshaping consumer shopping and retail payments across the globe. Although consumer spending is likely to recover over time, the way people shop and pay for goods and services may persistently change. At the same time, this creates new opportunities for banks and other payment providers to speed up the provision of contactless and online payment services. However, there is a group of elderly and low-income people that prefers to stick to cash. These people may on average be less digitally able or use cash as a way to monitor and manage their spending. Also, they may prefer some specific properties of cash, such as the anonymity of a cash payment, or perceive cash as less risky than digital money. For them, cash is still king.

Notes

Wilko Bolt is the corresponding author. E-mail: w.bolt@dnb.nl. For econometric approach and results this article draws on Jonker et al. (2020). The views expressed in this article do not necessarily reflect the views of DNB or those of the Eurosystem.

References

Arango-Arango, C., Bouhdaoui, Y., Bounie, D., Eschelbach, M. and Hernandez, L. (2018). Cash remains top-of-wallet! International evidence from payment diaries. Economic Modelling, 62, 38–48.

Bagnall, J. Bounie, D., Huynh, K., Kosse, A., Schmidt, T., Schuh, S. and Stix, H. (2016), Consumer cash usage: a cross-country comparison with payment diary survey data. International Journal of Central Banking, 12 (4), 1–61.

Bolt, W., Jonker, N. and van Renselaar, C. (2010). Incentives at the counter: An empirical analysis of surcharging card payments and payment behaviour in the Netherlands. Journal of Banking and Finance, 34, 1738–1744.

Chen, H., Engert, W. Huynh, K., Nicholls, G., Nicholson, M. and Zhu, J. (2020). Cash and COVID-19: The impact of the pandemic on the demand for and use of cash. Bank of Canada Staff Discussion Paper 2020-6.

Choi, H. and Loh, R. (2019). Physical frictions and digital banking adoption. Available at SSRN: https://ssrn.com/abstract=3333636 or http://dx.doi.org/10.2139/ssrn.3333636.

Coyle, K., Kim, L. and O’Brien, S. (2021). Consumer payments and the COVID-19 pandemic: The Second Supplement to the Findings from the 2020 Diary of Consumer Payment Choice. FED Notes, February, Federal Reserve Bank of San Francisco.

van der Cruijsen, C. and Knoben, J. (2020). Ctrl+C Ctrl+pay: Do people mirror electronic payment behavior of their peers? Journal of Financial Services Research, 59, 69-96. https://doi.org/10.1007/s10693-020-00345-6.

van der Cruijsen, C., and Plooij, M. (2018). Drivers of payment patterns at the point of sale: stable or not? Contemporary Economic Policy, 36 (2), 363–380.

van der Cruijsen, C. and van der Horst, F. (2019). Cash or card? Unravelling the role of socio-psychological factors. De Economist, 167 (2), 145–175.

Danmarks Nationalbank (2020). Payments before, during and after the corona lockdown. 16 September 2020-no 16.

DNB (2020a). DNBulletin: Shift of cash to debit card continues. Available at: https://www.dnb.nl/en/actueel/dnb/dnbulletin-2020/shift-of-cash-to-debit-card-continues/

DNB (2020b). DNB Factsheet “Point of sale payments during the COVID-19 pandemic”. Available at: https://www.dnb.nl/media/tehjvslf/betalen-aan-kassa-uk.pdf

ECB (2020). Study on the payment attitudes of consumers in the euro area (SPACE). December.

Golec, P., Kapetanios, G., Neuteboom, N., Ritsema, F. and Ventouri, A. (2020). Consumption during the covid-19 pandemic: Lockdown or fear? Evidence from transaction data for the Netherlands, King’s College London, Working Paper no. 2020/4, September.

Hernandez, L., Jonker, N. and Kosse, A. (2017). Cash versus debit card: the role of budget control. Journal of Consumer Affairs, 51 (1), 91-112.

van der Horst, F. and Matthijsen, E. (2013). The irrationality of payment behaviour. DNB Occasional Studies No. 11(4).

Jonker, N. (2007). Payment instruments as perceived by consumers: results from a household survey. De Economist 155(3), 271–303.

Jonker, N., van der Cruijsen, C., Bijlsma, M. and Bolt, W. (2020). Pandemic payment patterns. DNB Working Paper No. 701.

Jonker, N., Hernandez, L., de Vree, R. and Zwaan, P. (2018). From cash to cards. How debit card payments overtook cash in the Netherlands. DNB Occasional Studies No. 16(1).

von Kalckreuth, U., Schmidt, T. and Stix, H. (2014). Using cash to monitor liquidity: implications for payments, currency demand, and withdrawal behavior. Journal of Money, Credit and Banking, 46 (8), 1753–1785.

Khan, J., Belk, R. and Craig-Lees, M. (2015). Measuring consumer perceptions of payment mode. Journal of Economic Psychology, 47, 34–49.

Kosse, A. (2013). Do newspaper articles on card fraud affect debit card usage? Journal of Banking and Finance, 37(12), 5382–5391.

Mínguez, J., Urtasun, A. and García de Mirasierra, M. (2020). Consumption in Spain during the state of alert: an analysis based on payment card spending. Economic bulletin 3/2020.

Schuh, S. and Stavins, J. (2010). Why are (some) consumers (finally) writing fewer checks? The role of payment characteristics. Journal of Banking and Finance, 34 (8), 1745–1758.

Simon, J., Smith, K. and West, T. (2010). Price incentives and consumer payment behaviour. Journal of Banking and Finance, 34, 1759–1772.

Stavins, J. (2018). Consumer preferences for payment methods: Role of discounts and surcharges. Journal of Banking and Finance, 94, 35–53.

Wang, Z. and Wolman, A. (2016). Payment choice and currency use: Insights from two billion retail transactions. Journal of Monetary Economics, 84, 94–115.

WHO (2020). Guidance note on the role of Cash and Voucher Assistance to reduce financial barriers in the response to the COVID-19 pandemic. April.

Footnotes

| ↑1, ↑2, ↑5 | De Nederlandsche Bank (DNB), the Netherlands. |

|---|---|

| ↑3 | SEO Amsterdam Economics, the Netherlands. |

| ↑4 | Tilburg University, the Netherlands. |

| ↑6 | Vrije Universiteit, Amsterdam, the Netherlands. |

| ↑7 | See the press release https://www.cbl.nl/pinnen-als-voorzorgsmaatregelen-tegen-coronavirus/ (in Dutch). Also the WHO (2020) has been advising to not use paper tender and to use as many cashless options as possible to help contain the spread of the coronavirus. |

| ↑8 | There is a limited number of studies showing the importance of socio-psychological factors – e.g. social norms, attitudes, perceptions and feelings – for payment behaviour (van der Horst and Matthijsen 2013; Khan et al. 2015; van der Cruijsen and Knoben 2020; van der Cruijsen and van der Horst 2019). |