Authors

Hans Degryse[1]KU Leuven and CEPR., Roman Goncharenko[2]KU Leuven., Carola Theunisz[3]KU Leuven. and Tamas Vadasz[4]KU Leuven.

1. Introduction

Climate change is one of the largest environmental hazards affecting our society. There is a scientific consensus that greenhouse gas (GHG) emissions are at the root of the problem, the consequences of which are widespread. In particular, the rise in GHG emissions in the atmosphere is associated with an increase in global temperatures leading to extreme weather events and sea level rise, amongst others.

Governments have not been ignorant with regard to climate change. Already in 1992, the United Nations Framework Convention on Climate Change (UNFCCC) was established in order to ‘stabilize greenhouse gas emissions in the atmosphere’. Each year, the Conference of the Parties (COP) meet to assess the progress in dealing with climate change, to make pledges and to set out future objectives concerning climate change policies. The Paris Climate Accord (COP21) was the result of the 2015 convention. This Accord, signed by nearly 190 countries, aims to limit the increase in average global temperatures to 1.5 degrees Celsius relative to the pre-industrial level. The pathway towards a carbon-neutral economy is often referred to as the green transition.

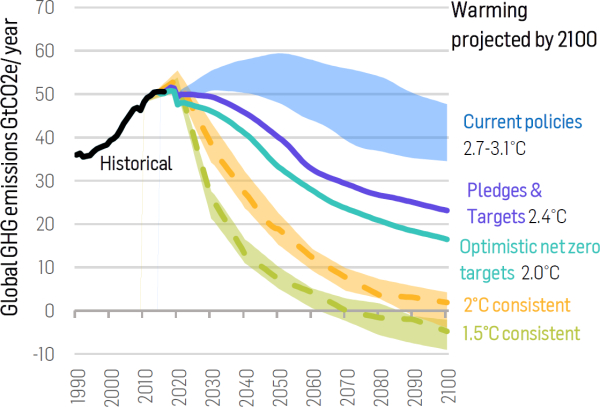

As a contribution to the green transition, countries have submitted national climate action plans, the so-called nationally determined contribution or NDCs. At the most recent convention, in Glasgow 2021, countries re-engaged ‘to keep the target of 1.5 degrees Celsius alive’. That is to say, the original pledges and climate policies were not sufficient to protect the planet from warming further, rising above the aimed 1.5 degrees Celsius. However, as Figure 1 below depicts, considering the current exhaust of GHG emissions and the expected warming based on the current NDCs, the projected warming will still far overshoot the aspirational Paris Accord target. In fact, as illustrated in the chart below, the policy gap is quite substantial.

Figure 1. 2100 Warming Projection: Emissions and expected warming based on pledges and current policies.

Source: Solactive, Climate Action Tracker (2021)

The uncertainty regarding future regulatory adjustments and the risks posed by climate change presents investors with significant challenges. These challenges are broadly classifiable into two risk groups. First, the financial system faces physical climate risks. These risks impact the financial sector directly. For example, as natural disasters occur more frequently and become more intense due to climate change, the materialization of climate-related physical risks can potentially result in large financial losses. Second, transition risks can be defined as risks of financial losses or economic dislocation related to the pathway towards a low-carbon economy and the accompanied policy tightening. They may impact the financial sector indirectly, through shifts in asset- and collateral values or higher costs of doing business. Physical risks and transition risks may interact with one another. For example, not making a transition (with effective policy measures) implies that the physical risks from climate change are likely to increase over time. Or the other way around, regulatory intervention which substantially speeds up the green transition at short-term economic costs could reduce the probability of future physical risks.

The Paris Climate Accord highlighted the role the financial system should play in accelerating the green transition. In fact, it recognized that finance could contribute to a swifter green transition provided that investors, financial institutions and other stakeholders would price in climate-related externalities. These externalities, which are at the root of the matter, are not yet consistently reflected in equilibrium prices. Because the current participants in the financial system that fund these activities do not necessarily suffer the losses and gains resulting from changes in physical or transition risks – most of which occur in the future – the financial system does not always internalize these losses and gains when making funding decisions. The green transition thus requires regulatory intervention that aims at internalizing climate-related externalities. By provoking the internalization of climate-related externalities such as GHG emissions – either directly through carbon taxes or other legislation affecting carbon-intensive industries – a market-based process of resource allocation can arise. This process is crucial to avoid market failure due to climate-related risks in the long run. Despite commitments already made, there is substantial uncertainty about when and how exactly such regulatory adjustments will take place, and whether decision makers are willing to take the potential short-term political costs. Such uncertainty makes particularly difficult to measure and rationally price in both types of climate risks.

2. A review of the empirical evidence

There is a growing body of evidence demonstrating that investors factor in environmental risk in their funding decisions, either because of their specific preferences (Riedl and Smeets, 2017) or because of the physical or transition costs that the risk entails (Krueger et al., 2020). There is empirical evidence that environmental risks are priced in equity markets (Bolton and Kacperczyk, 2021), option markets (Ilhan et al., 2021), bond markets (Fatica et al., 2019), and real-estate markets (Bernstein et al., 2019).

At the same time, the evidence on bank lending is more fragmented. For example, firms with environmental risks pay a higher loan spread and obtain loans granted by syndicates with fewer banks (Chava, 2014). There is also a significant negative relationship between voluntary disclosure of CO2 emissions and loan spreads for informationally opaque borrowers (Kleimeier and Viehs, 2018). Some further evidence indicates that environmental risks related to firms’ direct emissions are priced, but studies do not find differential pricing of these risks by green banks (Ehlers et al., 2021). Delis et al. (2021), however, find that green banks started to impose higher costs on syndicated loans to fossil fuel firms exposed to climate policies after the acceptance of the Paris Climate Accord.

Studying aggregate market outcomes, De Haas and Popov (2019) show that countries relying more on equity financing relative to bank lending are associated with lower per capita emissions and more green innovations, because stock markets steer investment towards carbon-efficient sectors. This seems to suggest that credit markets are impeding the pace of the green transition. This observation might be particularly worrisome for Europe, because European firms are much more reliant on bank credit compared to U.S. firms, as shown in Figure 2.

Figure 2. Size of financial market segments, 2016.

Source: Schoenmaker & Schramade, “Principles of Sustainable Finance”.

Source: Schoenmaker & Schramade, “Principles of Sustainable Finance”.

Relatedly, Degryse et al. (2020) demonstrate the existence of banking barriers to the green transition. In particular, banks’ legacy positions might induce credit rationing barriers to entry for innovative firms in polluting industries with large exposures to green technology disruption. Banks might decide to ration firms when their projects threaten to devalue banks’ legacy portfolio, either via collateral value drop or increase in probabilities of default. They further show that the banking market structure affects the rationing of new projects because firms face greater credit rationing when banks have homogeneous exposures to that industry.

When Green Meets Green

Yet, our recent paper shows that (at least a subset of) the banking system may be conducive to the green transition as banks are favourably pricing loans to firms exhibiting climate awareness (Degryse et al., 2021). In particular, we investigate whether and how the environmental consciousness (“greenness,” for short) of both firms and banks is reflected in the pricing of bank credit. Using a large international sample of corporate syndicated loans, we find that firms are indeed rewarded for being green in the form of cheaper loans. However, this only holds when borrowing from green lenders and, moreover, only after the ratification of the Paris Agreement. Hence, we find that environmental attitudes matter when “green meets green”.

Our empirical analysis requires proxies for the greenness of firms and banks. We classify a firm as green if it voluntarily reports to the Carbon Disclosure Project, an investor-oriented non-profit initiative to facilitate and standardize disclosure of a firm’s environmental impact. Firms reporting to the Carbon Disclosure Project are expected to have better in-house capabilities to measure and manage their exposure to the green transition of the economy, which can be viewed as evidence of their environmental consciousness. While previous studies showed that environmental performance as proxied by environmental scores matters for lending decisions, we refrain from using such metrics as these are often inconsistent over time, across industries, and among different providers (Berg et al., 2019). As such, our employed metric for firm’s greenness – which reflects a forward-looking measure of firm’s management of the risks posed by the green transition – seems to be more adequate to steer clear of discretion in methodologies.

Banks are classified as green if they are members of the United Nations Environment Programme Finance Initiative (UNEP FI), which aims to “mobilize private sector finance for sustainable development”. Since its creation in 1991, more than 160 leading banks have joined the Initiative. By stating their adherence, banks align their corporate governance with the UN Principles of Responsible Banking. Beyond setting objectively measurable targets with regard to their business activities, signatory banks commit to larger transparency with regular public reporting. To demonstrate that UNEP FI membership is beyond an empty promise, there is evidence that the Initiative’s signatory banks can issue green bonds with a premium because they can more clearly signal their environmental attitudes in lending (Fatica et al., 2019).

Using these proxies, we analyse the price information of corporate loans using a comprehensive international syndicated loans database for 2011–19. Figure 3 displays the loan spread density for both green and non-green firms in our sample. For green firms, the loan spread distribution is less right-skewed than for non-green firms. This already gives a first indication of a large unconditional green-effect and provides the basis for a more thorough econometric analysis. Unlike previous studies, we take a different tack by shedding light on the importance of lenders’ environmental attitudes in loan pricing decisions and examine whether the green-effect is stronger for loans given by green lenders in particular. We further investigate whether the Paris Agreement, which was reached on December 12, 2015, affected the relationship between firms’ and banks’ environmental attitudes and loan credit spreads.

Figure 3: Spread distribution of green vs. non-green borrowers.

Our results reveal the presence of a statistically and economically significant “green meets green” effect. To be specific, we estimate that green firms enjoy an average discount of approximately 50 basis points relative to non-green firms when borrowing from full green lender consortia. This effect is economically large as it is equivalent to a discount of one fifth of average loan spreads. Importantly, while the green-meets-green effect is insignificant before the Paris Agreement, as can be seen in Figure 4, it is statistically and economically significant after the agreement. This suggests that the green-meets-green effect is intimately linked to changes brought about by the Paris Agreement. We confirm this with a difference-in-difference-in-differences regression model. Moreover, we show that this effect survives different econometric analyses ruling out all sorts of selection issues and controlling for variables that may confound our results.

Figure 4. Visualization of estimated average coefficient that captures the green-meets-green effect on loan spreads using a sub-sample of loans with origination date preceding the Paris Agreement and a sub-sample of those originated after the acceptance date. The regression analysis controls for a rich set of relevant loan, borrower and lender characteristics and, moreover, exploits variation within firm’s industry-country-year clusters.

Why would the Paris Agreement have such a large indirect impact on lending terms, and why is this restricted to green banks? There is no doubt that more intense public discourse of climate change raises awareness among market actors, but it is not immediately clear how awareness translates to a specific equilibrium pricing. We argue in the paper that the observed empirical pattern is consistent with third-degree price discrimination by green banks with respect to firm’s greenness. First, we interpret the Paris Agreement as a shift in the perception of green transition risk, both by firms and by banks. Shifts in public opinion could lead to political pressure to strengthen environmental regulation, which could harm firms – and their lenders – that do not anticipate such shocks. Various interventions, previously unprecedented, are now on the table. For example, in May 2021 Royal Dutch Shell, a major player on the oil and gas market, was ordered by a Dutch court to cut its carbon emissions faster, overruling the firm’s own transition plans. This signaled to the market an increased likelihood that the judiciary system would become involved in climate issues in the future.

When the realization of a risk event is more likely, it becomes more important and more profitable to screen borrowers with respect to their exposure to such risks. Our proxy for green bank, that is, costly commitments to engage in aligning the banks’ business with climate objectives, means that such banks are necessarily more equipped to understand – as well as to systematically reflect in their pricing decisions – borrowing firms’ climate risk exposure. Similarly, participation in CDP signals that the firm has invested prior effort in understanding and measuring its exposure to climate transition risk, so it is naturally in a position to better cope with an eventual realization of such risks. Building on their superior expertise, green banks will reward green firms and punish non-green firms more than non-green banks do so. Through this mechanism, the increased awareness induced by the Paris Agreement translates to our documented green-meets-green effect.

On balance, our findings indicate that a subset of banks (viz., green banks) play a positive role in the green transition as they are favorably pricing loans to green firms relative to non-green firms. This holds when banks have a similar environmental consciousness — our “green-meets-green effect”. Putting climate change on the agenda through the Paris Agreement has fostered this attitude.

3. Regulatory implications

The landmark 2015 Paris Climate Agreement sets out a global framework to mitigate dangerous climate change by limiting average global warming well below 2°C and pursue efforts to limit it to an aspirational 1.5°C. To achieve these objectives, it called its negotiators to work on all key areas including mitigation, adaptation, finance, technology development and transfer, transparency of action, and capacity building. This should strengthen countries’ ability to deal with climate change and support them in making efforts. Improvement along these areas is essential to build resilience and decrease vulnerability to adverse climate change effects, the success of which will depend on the efficacy of the before-mentioned nationally-determined contributions (NDCs). Moreover, it will also depend on the commitment of non-party stakeholders in harnessing technological innovation and generating a momentum for the wider economy to switch to a new, carbon-neutral production matrix. As such, the Paris Agreement lays out a bridge between today’s policies and a sustainable future. In this section we talk to a number of ongoing policy debates.

Climate-related reporting

Financial stakeholders can accelerate the green transition by supporting emission reducing strategies and promoting green technology development. However, to steer informed investment, disclosure of comparable and reliable climate-related data or metrics will be absolutely fundamental. Therefore, establishing best practices and mandating standards for high quality data is something we should put considerable effort into going forward. As a matter of fact, as we show in our paper, firms that manage climate-related risks and invest in climate-related disclosure will be rewarded for their efforts in terms of access to cheaper bank credit given by green lenders (Degryse et al., 2021).

This underscores the importance of global efforts such as the Task Force on Climate-Related Financial Disclosure (TCFD) Initiative which was established in 2015 in order to develop robust and internationally consistent climate-related disclosures. Increasing the amount of standardized and reliable disclosure will provide better access to data required to appropriately manage and identify the exposures to climate-related risks and opportunities, to compare across companies and industries, and ultimately facilitate the financing of the green transition. An international adoption of the TCFD recommendations, by both non-financial and financial companies, would allow financial stakeholders to assess the carbon footprint of their portfolios, and report on their commitments in a transparent, comparable and consistent manner. Moreover, it will greatly open up the scope for research in contributing to a greater understanding of climate risks, improving modelling practices in measuring risks related to climate change, and strengthening the stability of the financial system.

An encouraging trend in this regard is the speed with which central banks around the world are joining the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) and taking steps towards TCFD-aligned financial disclosure. Cooperating under the NGFS-umbrella allows for deeper work on developing climate-related stress tests, integrating climate-related risks into financial stability monitoring and into monetary policy more generally.

Green Financial Institutions

What about bank financing? Demonstrating the role of banks’ legacy positions in their incentives to finance innovation, Degryse et al. (2020) stress the need for (public) green banks which are free from brown assets in order to promote the entry of innovative firms. As such, green bank initiatives could catalyse a swifter green transition by promoting competition and diversity among financial institutions and providing alternative funding sources for green technology innovation. Examples of such initiatives include the UK Green Investment Bank or the New York Green Bank. The introduction of legacy-free green banks would induce incumbent banks to counter-act the credit rationing of innovative firms.

In parallel, countries can take actions to counterbalance the tendency of credit markets in financing relatively carbon-intensive industries by introducing green credit guidelines that encourage banks to take environmental considerations into account in their lending decisions. For example, in 2014, the Brazilian central bank issued a number of resolutions on socio-environmental risk integration into banks’ risk management on top of the traditional credit, market and operational risks. This should help steer sustainable investment and improve the resilience of the financial system.

Along a similar vein, our findings are supportive of the idea that climate awareness on the lender’s side is a prerequisite for the greening of bank lending. This has been recognized in the public discourse on climate transition. For example, in 2021 Euromoney, a magazine on financial markets, selected BNP Paribas, who is a UNEP FI member, as winner of its “best bank for ESG data and technology 2021”, and praises that “the French bank put data at the heart of its sustainable finance strategy and devoted substantial resources to developing its data collection and processing capabilities”. This is a recognition of the fact that investment in technology, data and expertise on climate risk is an essential part of the transition process.

Lastly, countries with a bank-based financial system could stimulate the greening of their economy through further development of the conventional equity markets (De Haas and Popov, 2019). More broadly, the authors suggest that mandating an environmental objective for a European Capital Market Union might foster sustainable equity-based growth. Deepening stock markets by, for instance, re-assessing the tax shield on debt or by removing other obstacles that hamper equity-based investment, might promote the funding of low-carbon infrastructure and other climate solutions, and ultimately scale-up green investment.

Coordinated climate policy action

Climate change presents a global challenge and therefore requires a global coordinated policy response. While G20 leaders seek to strengthen their climate policies in support of the Paris Agreement, one issue that will undoubtedly come to play is the (lack of) coordination among policies implemented across different jurisdictions. For example, Benincasa et al. (2021) analyse whether banks exploit cross-country heterogeneity in climate policy stringency as a regulatory arbitrage tool. More specifically, investigating whether banks use cross-border lending to react to higher climate policy stringency in their home countries, the authors find that banks do indeed react to greater climate policy stringency in their home country by increasing their cross-border lending. This suggests that a lack of homogeneity and coordination in the regulations for climate change can reduce the effectiveness of such regulations through a bank lending channel.

Likewise, considering carbon taxes, Laeven and Popov (2021) show that after the introduction of a carbon tax, banks reallocate a large share of their fossil loan portfolio to countries without a carbon tax. This suggests that banks effectively shift carbon emissions across national borders to circumvent a negative impact of a carbon tax. This emphasizes the need for global policy coordination so as to mitigate the potential for regulatory arbitrage and improve the effectiveness of climate policy. Moreover, it acknowledges the need for policymakers to cooperate and assess the potential cross-border effects of policy measures adopted by national authorities in to order to allow cross-border authorities to respond by adopting suitable reciprocating measures. Nevertheless, we should reiterate the high value in taking coordinated actions to accelerate cooperative climate action in line with the objectives of the Paris Agreement.

4. Conclusion

Climate change risks are now in the focus of both public and political attention. The goals of the Paris Climate Agreement have provided governments, regulators and financial institutions with a roadmap for climate actions that will reduce emissions and build climate resilience. By directing financial flows towards sustainable activities and integrating environmental considerations into the investment process, the financial sector has great potential to shape sustainable economic systems.

In our paper, we explore whether green attitudes by firms as well as banks are reflected in the pricing of (syndicated) bank credit. Our findings, both empirically and theoretically, confirm that green attitudes are considered in pricing conditions in a significant way, and this was largely emanated following the adoption of the Paris Agreement. Specifically, we find that firms showing environmental consciousness in the form of voluntary climate-related disclosure enjoy more favourable terms of about 50 bps compared to other firms when borrowing from a consortium of green banks. This suggests that green banks have incentives to pursue third-degree price discrimination between green firms and other firms when the awareness of green transition risks is sufficiently high. These findings indicate that mandating climate-related financial disclosure and stimulating green bank initiatives can stimulate a market-based process of sustainable resource allocation and set the world on a path that should eventually avoid dangerous climate change effects.

References

Benincasa, E., Kabas, G., and Ongena, S. (2021). There is no planet B, but for banks there are countries B to Z: Domestic climate policy and cross-border bank lending. CEPR DP 16665.

Berg, F., Koelbel, J.F., and Rigobon, R. (2019). Aggregate confusion: The divergence of ESG ratings. MIT Sloan School of Management.

Bernstein, A., Gustafson, M. T., and Lewis, R. (2019). Disaster on the horizon: The price effect of sea level rise. Journal of Financial Economics, 134: 253–72.

Bolton, P., and Kacperczyk, M. (2021). Do Investors Care About Carbon Risk? Journal of Financial Economics, 142(2): 517-549.

Chava, S. (2014). Environmental Externalities and Cost of Capital. Management Science, 60 (9): 2223-2247.

De Haas, R., and Popov, A. (2019). Finance and Carbon Emissions. ECB Working Paper Series No. 2318.

Degryse, H., Goncharenko, R., Theunisz, C., and Vadasz, T. (2021). When Green Meets Green. CEPR Discussion Paper DP16536.

Degryse, H., Roukny, T., and Tielens, J. (2020). Banking Barriers to the Green Economy. NBB Working Paper Research No. 391.

Delis, M., de Greiff, K., Iosifidi, M., and Ongena, S. (2021). Being Stranded with Fossil Fuel Reserves? Climate Policy Risk and the Pricing of Bank Loans. Swiss Finance Institute Research Paper Series No. 18-10.

Ehlers, T., Packer, F., and de Greiff, K. (2021). The Pricing of Carbon Risk in Syndicated Loans: Which Risks are Priced and Why? Journal of Banking and Finance, forthcoming.

Fatica, S., Panzica, R., and Rancan, M. (2019). The Pricing of Green Bonds: Are Financial Institutions Special? JRC Working Papers in Economics and Finance.

Ilhan, E., Sautner, Z., and Vilkov, G. (2021). Carbon Tail Risk. Review of Financial Studies, 34(3): 1540-1571.

Kleimeier, S., and Viehs, M. (2018). Carbon Disclosure, Emission Levels, and the Cost of Debt. SSRN Working Paper.

Krueger, P., Sautner, Z., and Starks, L. T. (2020). The Importance of Climate Risks for Institutional Investors. Review of Financial Studies, 33(3): 1067–111.

Laeven, L., and Popov, A. (2021). Carbon Taxes and the Geography of Fossil Lending. CEPR DP16745

Riedl, A., and Smeets, P. (2017). Why Do Investors Hold Socially Responsible Mutual Funds? Journal of Finance, 72(6): 2505–50.