With the creation of the Banking Union and the launch of a new macroprudential policy framework, banking supervision in Europe has become significantly more complex than it used to be. The coexistence of micro- and macro-prudential regimes that rely on similar tools to pursue different objectives may at times give place to conflicting policy interventions. This risk is structurally higher in bank-based economies with highly concentrated banking sectors. It may be further heightened in the contractionary phase of the cycle, when policymakers face a short-run trade-off between the resilience of the financial sector and the speed of the recovery. Coordination is thus a critical issue today in the euro area. In order to deal with it, supervisors need to agree on a ranking between their policy objectives, internalise the interactions between micro and macroprudential tools, and consider the general equilibrium effects of their interventions on the economy of the area.

Banking supervision has undergone two radical reforms in Europe over the last four years. The first one was the creation of the Banking Union. The bail out of Dexia in October 2011 demonstrated that large ‘systemic’ institutions are both hard to supervise and difficult to wind down for national authorities. With the creation of the Single Supervisory Mechanism (SSM) and the Single Resolution Mechanism (SRM), these tasks have been transferred into the hands of supra-national agencies. The SSM, formed by the European Central Bank (ECB) and national supervisory authorities, is now the chief microprudential supervisor of the euro area. The second important novelty was the launch of a “macroprudential” policy framework. The crisis demonstrated that the resilience of a financial system does not boil down to that of its individual components (the ‘fallacy of composition’ of e.g. Danielsson et al. 2013); this pushed regulators in Europe and elsewhere to introduce new macroprudential tools that operate on the financial sector as a whole, aim specifically at controlling systemic risks, and can be used counter-cyclically to smooth both the expansionary and contractionary phases of the financial cycle (ESRB, 2014).

The overhaul of the traditional microprudential policy framework (henceforth MIP) and the introduction of a new macroprudential regime (henceforth MAP) thus find equally strong motivations in the history of the last decade. Their combination, however, has made banking supervision significantly more complex than it used to be. The coexistence of decision makers that have different scopes and objectives but operate on the same set of tools poses a question: how, if at all, should they coordinate[1]The view that MIP and MAP differ in terms of objectives rather than tools is shared e.g. by Bank of England (2011) and Angelini et al. (2013).?

What makes coordination an interesting problem is primarily the link between capital requirements, credit and economic activity[2]We focus on bank capital requirements because it is the instrument that micro and macro supervisors are working with most intensely and probably the one for which their interaction is most direct. … Continue reading. As long as a variation in capital requirements affects credit supply, and this feeds through to output and prices, MAP and MIP authorities have a structural reason to disagree on how the requirements should change over the business cycle. MAP authorities internalise the trade-off between capital and credit, whereas MIP authorities operating on individual institutions do not. Hence, the ‘shadow value’ they attach to an additional unit of bank capital is different: raising capital in a recession is naturally more costly for a MAP authority[3]The nature of the linkage between capital requirements and credit supply is of course hard to gauge and has been intensely scrutinized over the last few years. Cecchetti (2014) argues that the … Continue reading. A further complication is that ‘micro’ policies are not restricted to operate on individual institutions but are sometimes implemented simultaneously on the entire banking system: an example in the Euro area is the Supervisory Review and Evaluation Process (SREP) provided for in CRD IV. System-wide MIP interventions are de facto equivalent to a MAP intervention, and are likely to affect aggregate credit and economic activity. Since in this case MIP and MAP authorities operate through the same transmission mechanisms, in principle they should attach the same ‘shadow value’ to bank capital and agree naturally on how the requirements should be set. However, policies can still diverge. In fact, their mandate typically induces MIP supervisors to focus on a shorter time horizon or simply to overlook the macroeconomic implications and the systemic implications of their choices.

If one looks at the coordination problem through this lens, the reasons why it is critical in Europe today become immediately clear. On the one hand, the need to support the recovery by stimulating credit supply ranks high in policy-makers’ agenda (Draghi, 2014). On the other hand, the link between capital requirements and aggregate credit – and hence the contractionary spillover of a regulatory tightening – is likely to be stronger in the bank-based economies of the euro area than in countries, such as the US or the UK, where households and firms have access to a number of alternative funding sources. A further complication stems from the high level of concentration of European banking markets. To see why concentration matters, think of a one-bank economy hit by a sudden recession. The MIP authority would presumably raise capital requirements to protect the bank from increasing credit risks, while the MAP authority could lower the (countercyclical) ‘systemic’ capital requirement to avoid a credit crunch that would make the recession worse. Since the system is the bank, these interventions neutralise one another leaving the overall supervisory stance unchanged. In an economy with N smaller and heterogeneous banks the problem is less severe. In this case a fall in the systemic requirement can be combined with an increase in microprudential requirements for the k<N banks the MIP supervisors identify as fragile. Capital requirements fall in net terms for N-k sound banks, so MAP is somehow diluted by MIP, but the dilution is only partial and it stimulates a desirable reallocation of credit from fragile to sound institutions.

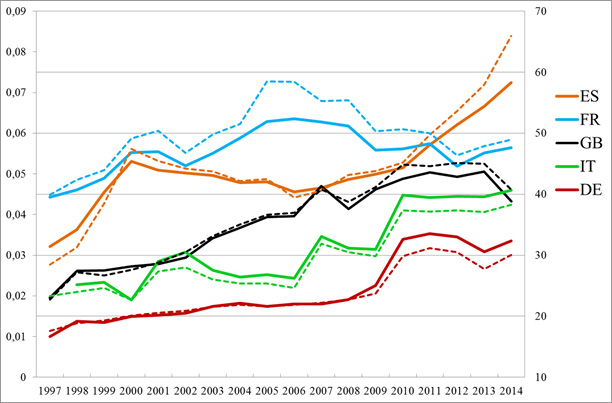

As Figure 1 shows, Europe is closer to the one-bank case than to the N-banks case. The figure focuses on the four largest economies of the euro area plus Great Britain, and reports two measures of banking concentration: the Herfindhal index calculated on all domestic credit institutions, and the share of total assets held by the five largest domestic banking groups. The indicators have been on an upward-sloping trend since 1997, and the crisis clearly has not changed the picture. Furthermore, the two indicators are strongly correlated within each country, which suggests that concentration is primarily driven by the increasing importance of a handful of large players. This means that European supervisors have a structural reason to take coordination problems very seriously[4]A broader international comparison may also be instructive: between 2005 and 2011, the market share of the three largest banks in the European Union as a whole increased from 46% to over 60%; in the … Continue reading.

The governance structure of the euro area is conceptually appealing because it puts authorities in a good position to insure coordination between MIP and MAP at both the European and the national level. The crucial feature of the framework is that, under the SSM, the ECB retains both MIP responsibilities and MAP powers to adjust the policy stance adopted by individual national authorities, in coordination with the European Systemic Risk Board (through CRR/CRD IV). The ultimate decision maker is thus the Governing Council, which interacts closely with the Supervisory Board of the SSM and is called to form a judgment on draft decisions submitted by the latter on both micro and macroprudential matters. Hence, the Council should be able to internalise any tensions between MIP and MAP and enforce a well-defined hierarchy between the two. But how should such a hierarchy be defined in principle? And how can we make sure that it is credible and that it works in practice?

The MAP objective of reducing systemic risk appears to be logically prior to the MIP objective of preventing idiosyncratic bank failures. This ranking arises for three complementary reasons. First, no individual bank can be safely deemed to be sound if significant systemic risks loom large in the economy. As we learned in 2008-2009, even liquid and well-capitalised banks can quickly be cornered by the sudden seizure of funding markets or by asset depreciations caused by fire sales. Second, idiosyncratic bank failures are harmful mainly because of their systemic spillovers: a given bank’s default may or may not constitute a serious problem depending on whether or not its counterparties are able to withstand its demise. This means that an effective management of MAP can make the ex-ante cost associated to MIP mistakes much smaller – and, symmetrically, a misuse of MAP can hugely increase the burden on MIP authorities. Third, experience shows that big, well-diversified banks are resilient to idiosyncratic shocks and are unlikely to become insolvent without a systemic shock. In other words, systemic fire sales and liquidity shortages may be both necessary and sufficient conditions for large banks to fail. Since MAP is designed precisely to prevent events of this kind, the individual resilience of these institutions ultimately depends on MAP as much as on MIP. It follows that, by and large, MIP should work to fine-tune regulatory requirements for individual institutions subject to MAP providing an adequate level of financial stability at the aggregate level (ECB, 2014).

Once a ranking of micro and macroprudential objectives has been agreed, the issue arises of how it can be implemented and rendered credible from the public’s perspective. This takes us into a political economy arena where the agency problems associated to the (largely implicit) contract between the supervisors and their constituencies become important. One aspect of this problem that has received significant attention is the possibility of an inaction bias in supervision. While the costs of restrictive MAP measures may appear rapidly, their benefits in terms of systemic risk mitigation may accrue only in the future and might be harder to gauge both for the regulator and for the general public. Hence, MAP authorities may be unwilling to take restrictive actions in a boom, undermining the counter-cyclicality of the MAP regime. This argument has been often advanced in policy and research circles[5]Knot (2014), Freixas and Parigi (2009), Goodhart (2011).. In this sense, the difficulty of ‘taking the punch bowl away during a party’ is an important and well-understood lesson from the financial crisis.

However, supervision might also be affected by a bias that operates in the opposite direction. Although evaluating a supervisor’s performance is generally difficult for outsiders, this difficulty is clearly asymmetric: the negative implications of lax supervision (bank failures) are easier to verify than those of an overly restrictive one (an inefficiently low rate of credit or economic growth). A suboptimal growth rate is not only harder to identify but also easier to blame onto somebody else – for instance the government, the monetary policy authority, or international competition. Hence, supervisors are ultimately in the spotlight if banks fail and not, or not nearly as much, if growth is weak. This asymmetry may generate an “accountability bias” of sorts, twisting the regulatory regime towards a sub-optimally restrictive stance. The most extreme manifestation of this problem would occur in a situation where (i) supervisors care mostly about their own reputation, and (ii) the public’s only source of information on their effectiveness is banks’ actual ability to withstand negative shocks[6]Banks’ actual survival is a noisy signal on the quality of the underlying supervision: it is informative, because good supervision enhances a bank’s probability of emerging unscathed from a … Continue reading. In this case supervisors would certainly tighten regulatory requirements beyond the socially optimal point, because this would allow them to maximise their private payoff (reputation) at the expense of public outcomes (optimal levels of credit or economic growth)[7]An early formulation of a similar problem can be found in Boot and Thakor (1993). In their model supervisors monitor banks’ portfolio choices and decide whether or not banks are viable. As in our … Continue reading. Since private incentives cannot be changed by simply creating new labels and policy frameworks, MIP and MAP authorities may be equally likely to fall foul to behavioural biases of this kind despite having different objectives. This means that even if the authorities agree in theory that MAP should work counter-cyclically, and prevail over MIP when there is a conflict between the two, there is no guarantee that such a set up will be maintained in practice. As in other areas of public policy, agency problems can force a (large) wedge between theory and practice.

In conclusion, in the concentrated bank-based economies of the euro area the coordination of micro and macroprudential policies is, in our view, crucial to the overall success of the new supervisory framework. We argue that it can be achieved under two conditions: supervisors should (i) place macroprudential policy at the centre of the framework and (ii) internalise the interactions between micro and macroprudential tools and their general equilibrium effects on the economy of the area. Above all, they should acknowledge that there is a coordination issue that needs to be dealt with. Being clear on the relation between micro and macroprudential supervision today is at least as important as getting the policy interventions right. The costs of setting a bad precedent, weakening the credibility of macroprudential policy or creating uncertainty on the overall logic of the supervisory framework, could be extremely large. To contain them, supervisors should make sure that their decisions are derived from first principles, rest on sound economic analysis and are clearly linked to their mandates.

Figure 1: Increasing concentration in European banking sectors.

Source: ECB Statistical Data Warehouse. For each country, the continuous line is the Herfindhal index calculated on all domestic credit institutions (left axis) and the dashed line is the share of assets held by the five largest domestic banking groups (right axis, in percentage points).

References

Alessandri, P., and Panetta F., (2015). Prudential policy at times of stagnation: a view from the trenches, Bank of Italy Occasional Paper n.300, December.

Angelini, P., Nicoletti-Altimari, S., & Visco, I. (2012). Macroprudential, microprudential and monetary policies: conflicts, complementarities and trade-offs, in Dombret, A., Lucius, O. (eds.), Stability of the Financial System – Illusion or Feasible Concept?, Elgar Edwards Publishing.

Aiyar, S., Calomiris, C. W., & Wieladek, T. (2014). Does Macro‐Prudential Regulation Leak? Evidence from a UK Policy Experiment. Journal of Money, Credit and Banking, 46(s1), 181-214.

Bank of England, (2011). Instruments of Macroprudential Policy, Discussion Paper, December.

Bijlsma, M. J., & Zwart, G. T. (2013). The changing landscape of financial markets in Europe, the United States and Japan (No. 2013/02). Bruegel Working Paper.

Boot, A. W., & Thakor, A. V. (1993). Self-interested bank regulation. The American Economic Review, 206-212.

Cecchetti, S., (2014). The jury is in, CEPR Policy Insight n.76

Danielsson, J., Shin, H.S. and Zigrand J-P., (2013). Endogenous and systemic risk, chapter 2 in Joseph G. Haubrich and Andrew W. Lo eds., Quantifying Systemic Risk, University of Chicago Press, November.

Draghi, M., (2014). Monetary Policy in a Period of Prolonged Inflation, speech delivered at the ECB Forum on Central Banking, Sintra, May.

European Systemic Risk Board, (2014). Flagship report on macroprudential policy in the banking sector, March.

Freixas, X., and Parigi, B.M., (2009). Rules vs discretion in times of financial liberalization, manuscript.

Goodhart, C. A. (2011). The macro-prudential authority: powers, scope and accountability. OECD Journal, 97.

Jiménez, G., Ongena, S., Peydrò, J.L., and Saurina, J., (2015). Macroprudential policy, countercyclical bank capital buffers and credit supply: evidence from the Spanish dynamic provisioning experiments, European Banking Center Discussion Paper No. 11.

Footnotes

| ↑1 | The view that MIP and MAP differ in terms of objectives rather than tools is shared e.g. by Bank of England (2011) and Angelini et al. (2013). |

|---|---|

| ↑2 | We focus on bank capital requirements because it is the instrument that micro and macro supervisors are working with most intensely and probably the one for which their interaction is most direct. The coordination problem we highlight however is a general one, and may in principle also arise when regulating liquidity, maturity transformation or market activity. |

| ↑3 | The nature of the linkage between capital requirements and credit supply is of course hard to gauge and has been intensely scrutinized over the last few years. Cecchetti (2014) argues that the connection is at best tenuous; but Aiyar et al. (2014) and Jimenez et al. (2015) provide microeconometric evidence that UK and Spanish banks tightened lending significantly in response to changes in regulatory requirements in the past. |

| ↑4 | A broader international comparison may also be instructive: between 2005 and 2011, the market share of the three largest banks in the European Union as a whole increased from 46% to over 60%; in the US it went from 20% to 30%, while in Japan it remained stable at about 40% (Bijlsma and Zwart, 2013). |

| ↑5 | Knot (2014), Freixas and Parigi (2009), Goodhart (2011). |

| ↑6 | Banks’ actual survival is a noisy signal on the quality of the underlying supervision: it is informative, because good supervision enhances a bank’s probability of emerging unscathed from a stress situation, but noisy, because this correlation is not perfect. |

| ↑7 | An early formulation of a similar problem can be found in Boot and Thakor (1993). In their model supervisors monitor banks’ portfolio choices and decide whether or not banks are viable. As in our example, the supervisors’ monitoring ability cannot be observed by outsiders, which gives them an incentive to build up their reputation. Boot and Thakor show that supervisors can boost their reputation by keeping bad banks afloat: since a foreclosure signals a previous supervisory fault, supervisors let insolvent banks operate longer than they should, hoping that positive shocks will allow them to recover. Our example illustrates that the same reputational motive can also distort regulatory requirements: higher requirements (ex-ante) and a lax bank closure policy (ex post) can be seen as alternative ways for supervisors to protect their reputation. |