Authors

José Manuel Mansilla-Fernández[1]Public University of Navarre (UPNA) and Institute for Advanced Research in Business and Economics (INARBE).

Figure 1. The status of Central bank digital currencies projects in the world

Notes: Map retrieved from CBDC Tracker. Available at: https://cbdctracker.org/. Accessed on September 10, 2024.

Figure 2. Central bank digital currencies project status and central bank independence

Notes: Own elaborations. Project score, measured in the horizontal axis, is an index that takes the value 0 for jurisdictions without any CBDC work publicly announced by the central bank, 1 for projects in early stages, 2 for pilot projects, and 3 for jurisdictions that have already introduced a CDBC; data are the updated version of those in Auer et al. (International Journal of Central Banking, 2023), available at https://www.bis.org/publ/work880.htm. Central banks’ independence, measured on the vertical axis ranges from 0 (the lowest level of independence) to 1 (the highest level of independence); data are the updated version of those in Romelli (2022, Economic Policy), available at https://dromelli.github.io/cbidata/index.html. The size of the bubbles represents the aggregate GDP of the countries in each category. The sample includes 124 countries.

Figure 3. Central bank digital currencies project status and central bank responsibility for banking supervision

Notes: Own elaborations. Project score, measured in the horizontal axis, is an index that takes the value 0 for jurisdictions without any CBDC work publicly announced by the central bank, 1 for projects in early stages, 2 for pilot projects, and 3 for jurisdictions that have already introduced a CDBC; data are the updated version of those in Auer et al. (International Journal of Central Banking, 2023), available at https://www.bis.org/publ/work880.htm. Central banks’ responsibility for banking supervision, measured on the vertical axis ranges from 0 (banking supervision not entrusted to the central bank) to 0 (banking supervision entrusted to the central bank alone); data are the updated version of those in Romelli (2022, Economic Policy), available at https://dromelli.github.io/cbidata/index.html. The size of the bubbles represents the aggregate GDP of the countries in each category. The sample includes 124 countries.

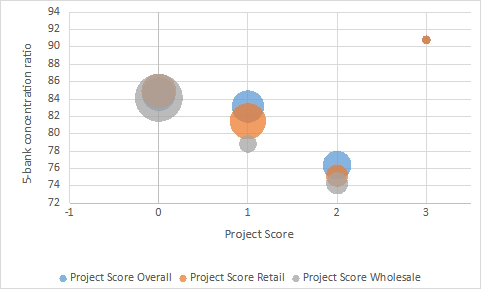

Figure 4. Central bank digital currencies project status and bank concentration.

Notes: Own elaborations. Project score, measured in the horizontal axis, is an index that takes the value 0 for jurisdictions without any CBDC work publicly announced by the central bank, 1 for projects in early stages, 2 for pilot projects, and 3 for jurisdictions that have already introduced a CDBC, distinguishing between retail and wholesale projects; data are the updated version of those in Auer et al. (International Journal of Central Banking, 2023), available at https://www.bis.org/publ/work880.htm. Bank concentration, measured in the vertical axis, is the share of total assets of the three largest banks in each country; data are from the World Bank Global Financial Development Database, available at https://www.worldbank.org/en/publication/gfdr/data/global-financial-development-database. The sample includes 140 countries.

Figure 5. Central bank digital currencies project status and payment habits.

Notes: Notes: Own elaborations. Project score, measured in the horizontal axis, is an index that takes the value 0 for jurisdictions without any CBDC work publicly announced by the central bank, 1 for projects in early stages, 2 for pilot projects, and 3 for jurisdictions that have already introduced a CDBC, distinguishing between retail and wholesale projects; data are the updated version of those in Auer et al. (International Journal of Central Banking, 2023), available at https://www.bis.org/publ/work880.htm. Payment habits, measured in the vertical axis, are measured by the share of the population 15 years of age or older that made a digital payment in each country; data are from the World Bank Global Financial Development Database, available at https://www.worldbank.org/en/publication/gfdr/data/global-financial-development-database. The sample includes 113 countries.

Footnotes

| ↑1 | Public University of Navarre (UPNA) and Institute for Advanced Research in Business and Economics (INARBE). |

|---|